Key Takeaways

Convertible securities have offered equity-like return potential with reduced volatility, allowing for gains during market ups and benefiting from protection when markets decline.

Favorable new issuance conditions are broadening the pool of attractive convertible investment options.

Active management is key to leveraging opportunities and managing risks in the evolving market environment.

Over the last 35-plus years, U.S. convertibles have produced equity-like performance but with lower volatility. And thanks to accelerated new issuance at favorable terms, today’s opportunity set has expanded, adding to the appeal of this unique asset class.

What are convertible securities?

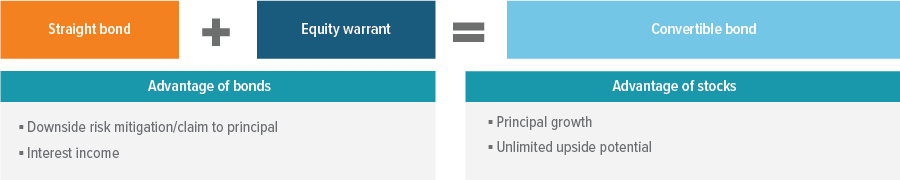

A convertible security is a traditional bond that can be converted or exchanged into a specific number of shares of the issuer’s common stock. Convertibles have characteristics of both bonds and stocks (Exhibit 1), which can help improve a portfolio’s overall risk-adjusted returns.

- The bond component provides income potential and reduced volatility, derived from the stated coupon and maturity and the claim to principal. Like other bonds, a convertible’s value can fluctuate with changes in interest rates and the credit quality of the issuing company. It should be noted that convertible securities generally have a lower coupon than corporate bonds, but they usually offer a yield advantage over the common stock dividend.

- The equity component provides unlimited capital appreciation potential, derived from an option (determined at issuance) that provides the right to convert into a fixed number of common shares. Because of this feature, when convertible securities mature, they can be redeemed at the market value of the underlying common shares or at their face value—whichever is higher.

How do convertible securities behave?

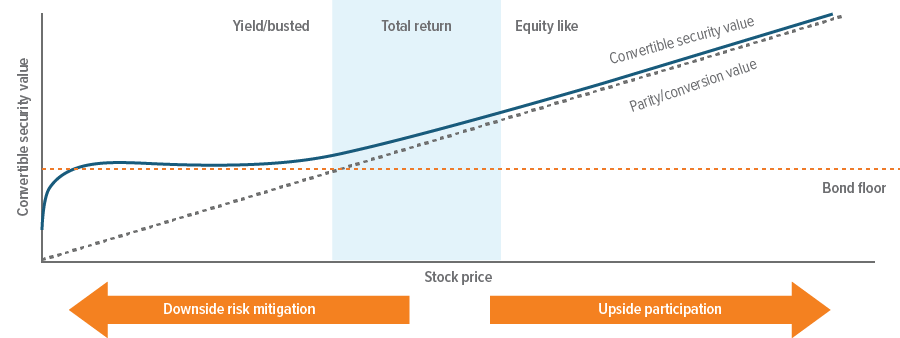

The behavior of a convertible security may take on either stock-like or bond-like characteristics, depending upon where the underlying stock is trading in relation to the bond’s conversion price. The security tends to become more equity like as the price of the common shares rises (Exhibit 2), which means its participation in the stock’s upside may increase.

Source: Voya IM. For illustrative purposes only.

Source: Voya IM. For illustrative purposes only.

As the underlying stock price falls, the convertible may act more bond like, which means its participation in the stock’s downside tends to decrease. It is important to note that convertibles are subject to the same risk factors as stocks and bonds, including market, interest rate and credit risks.

There are three types of convertible securities:

1. Yield/busted. Convertibles in this category are characterized by high yields and high conversion premiums. Given that the equity option is out of the money, these securities behave more like corporate bonds, with little regard given to the option value.

- Behave more like fixed income instruments

- Low correlation to the underlying equity

- Delta below 0.41

2. Total return. Convertibles in this category exhibit ideal qualities, characterized by moderate conversion premiums and some equity sensitivity.

- Provide an asymmetric risk/reward profile

- Capture more of the upside and less of the downside of the underlying equity

- Delta between 0.4 and 0.8

3. Equity like. Convertibles in this category behave like equity investments, characterized by lower conversion premiums and a high degree of equity sensitivity.

- Behave more like equity instruments

- High correlation to the underlying equity

- Delta greater than 0.8

Why consider investing in convertible securities?

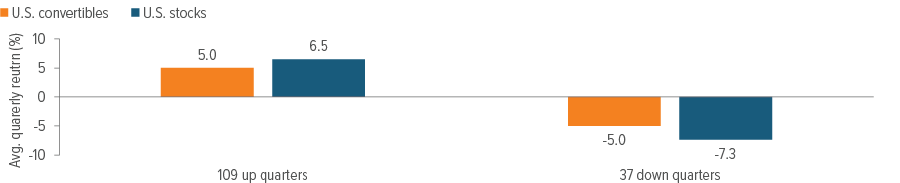

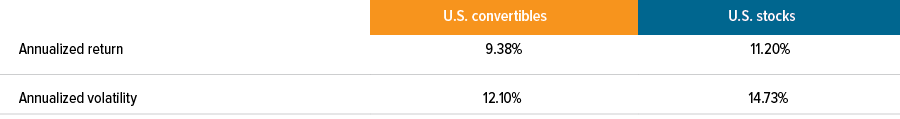

Convertible securities offer an asymmetric risk/reward profile in which the upside opportunity (reward) exceeds the downside capture (risk). Over the last 25- plus years, the asset class has produced equity-like performance but with lower volatility. This attribute is unique to the convertible market and can play a valuable role in a portfolio (Exhibits 3 & 4).

Terms to know

|

As of 06/30/24. Source: FactSet, ICE Data Services, Voya IM, Morningstar. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favorable. U.S. convertibles: ICE BofA U.S. Convertibles Index. U.S. stocks: S&P 500 Index. See index associations and additional disclosures at the end of this document.

What’s compelling about convertibles today?

Improving new issuance

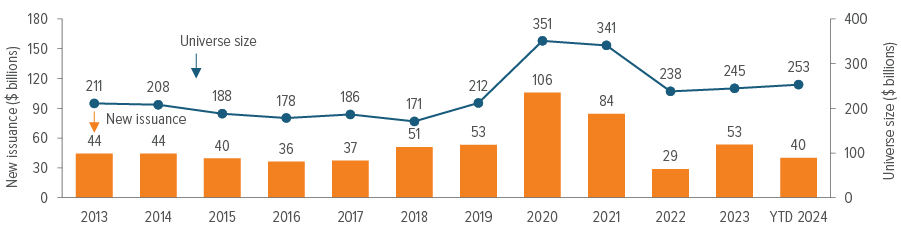

U.S. convertible new issuance has picked up in 2024, as financing costs have risen along with interest rates. Higher debt financing costs have drawn issuers to the convertible market for coupon savings. As a result, market analysts continue to estimate that new issuance in 2024 could reach $80 billion, well above 2022 and 2023 totals and in line with or above pre-Covid levels (Exhibit 5).

Due to the rise in interest rates over the last few years, new issuance carries much more attractive terms for convertible security investors. Specifically, coupons rose from ~1.5% (record low) in 2021 to ~3.5% through July 2024. In addition, average initial conversion premiums narrowed from 36% (record high) to ~32% over that same period.2

Increasing new issuance at more attractive terms expands the opportunity set of total return convertibles, which offer a compelling asymmetric risk/ reward profile.

As of 06/24. Source: Voya IM (using data from ICE Data Indices, LLC). Projections are based on assumptions with respect to future events. The actual future events may differ from the assumptions. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favorable. See index associations and additional disclosures at the end of this document.

A broadening out of the market

The convertible market has faced several headwinds in recent years.

Tightening monetary policy, credit spread widening, recessionary concerns and convertible-market-specific factors caused the asset class to capture more downside than expected in 2022. By year-end, many convertible securities traded closer to their bond floors, pushing the overall market’s delta (equity sensitivity) sharply lower.3

Since 2023, the asset class has participated in some of the equity market’s recovery but lagged broader indexes, whose gains were largely driven by mega-cap companies.4 Additionally, the convertible market’s lower delta entering 2023 had the effect of limiting upside capture.3

While a change in market leadership is not a certainty, a sustained broadening of the equity market should be a positive development for convertible investors. Given the asset class’s skew away from mega-cap companies, which have driven equity performance recently, we believe convertibles are well positioned to benefit from greater market breadth.

Active managers can take advantage of market opportunities

Passive investment strategies cannot adjust to changes in the convertible market’s composition, issuer fundamentals or individual issue characteristics, among other factors. In addition, these strategies do not have discretion related to new issuance.

Active management is critical to minimizing portfolio risks—such as fundamental/credit and concentration risks—while adjusting to changing risk/reward profiles (i.e., delta, conversion premiums, etc.) of individual issues, which are driven by the movement of the underlying equity.

Three takeaways about convertibles

|

A note about risk

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All security transactions involve substantial risk of loss. Debt instruments: Debt instruments are subject to greater levels of credit and liquidity risk, may be speculative, and may decline in value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default. Market volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Price changes may be short or long term. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio’s manager(s) to invest the portfolio’s assets as intended. Issuer risk: The portfolio will be affected by factors specific to the issuers of securities and other instruments in which the portfolio invests, including actual or perceived changes in the financial condition or business prospects of such issuers. Interest rate risk: The values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities. Credit risk: If the issuer of a debt instrument fails to pay interest or principal in a timely manner, or negative perceptions exist in the market of the issuer’s ability to make such payments, the price of the security may decline.