1 The investment opportunities described herein are for reference only but not guaranteed and are not indicative of future performance. The risks described herein are not meant to be exhaustive, please refer to the offering documents for details of risk factors.

Voya Investments Distributor, LLC (VID) serves as the exclusive distributor of Allianz Global Investors GmbH (AllianzGI) managed Allianz Global Investors funds sold through intermediaries based in the U.S. and Canada to clients residing outside of the U.S. or Canada. VID is a brokerdealer registered with the U.S. Securities and Exchange Commission (SEC) and member of the Financial Industry Regulatory Authority (FINRA). Voya Investment Management and VID are not affiliates of AllianzGI.

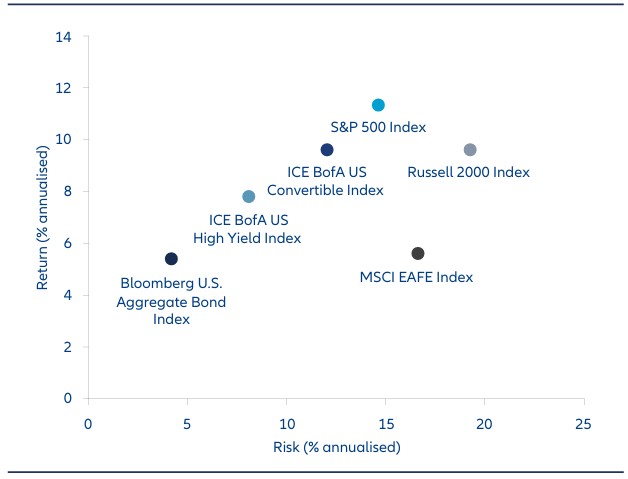

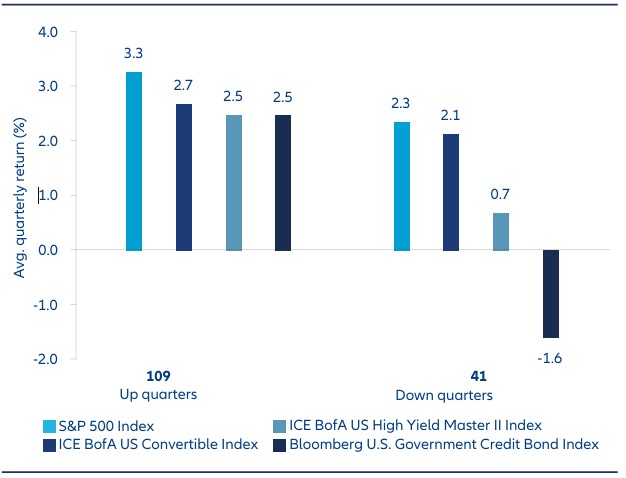

Diversification does not guarantee a profit or protect against losses. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Indices are unmanaged and an individual cannot invest directly in an index. The Bloomberg US Government Credit Bond Index contains U.S. Treasuries and agencies, Yankee and US corporate debentures, and secured notes (publicly issued). The ICE BofA US Treasury Index tracks the performance of the direct sovereign debt of the U.S. Government. It includes all U.S. dollar-denominated U.S. Treasury notes and bonds having at least one year remaining to maturity and a minimum amount outstanding of $1 billion. Additional sub-indices are available that segment the Index by maturity. The ICE BofA Euro High Yield Index tracks the performance of Euro denominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets. The ICE BofA Global Corporate Bond Index provides a broad measure of the performance of the global investment grade corporate bond market. It includes publicly issued corporate debt issued in the major domestic and Eurobond markets. The ICE BofA High Yield Master II Index is an unmanaged index consisting of U.S. dollar denominated bonds that are issued in countries having a BBB3 or higher debt rating with at least one year remaining till maturity. All bonds must have a credit rating below investment grade but not in default. The ICE BofA US Convertibles Index tracks the performance of publicly issued US dollar denominated convertible securities of U.S. companies. The Bloomberg U.S. Credit Index is the credit component of the U.S. Government/Credit index. It includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements. To qualify, securities must be rated investment grade (Baa3 or better) by Moody’s. The index is the same as the former U.S. Corporate Investment Grade Index. The Bloomberg U.S. Aggregate Bond Index tracks investment-grade bonds, including U.S. Treasurys and corporate bonds. The JP Morgan EMBI Global index is an unmanaged, market-capitalisation weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities. The MSCI Europe, Australasia, Far East (EAFE) Index is an unmanaged index of over 900 companies, and is a generally accepted benchmark for major overseas markets. The Russell 2000 Index is an unmanaged index that consists of the 2,000 smallest companies in the Russell 3000 Index and represents approximately 10% of the total market capitalisation of the Russell 3000 Index. It is generally considered representative of the small-cap market. The S&P 500 Index is a free-float market capitalisation-weighted index of 500 of the largest U.S. companies.

The sub-fund is not for sale to or for the benefit of any U.S. person. Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. The volatility of fund unit/share prices may be increased or even strongly increased. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. For a free copy of the sales prospectus, incorporation documents, daily fund prices, Key Information Document, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or regulatory.allianzgi. com. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info). The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted, except for the case of explicit permission by Allianz Global Investors GmbH. Shares of the Funds are only available for certain non-U.S. persons in select transactions outside the United States, or, in limited circumstances, otherwise in transactions which are exempt in reliance on Regulation S from the registration requirements of the United States Securities Act of 1933, as amended and such other laws as may be applicable. This document does not constitute an offer to subscribe for shares in the Fund. This document should not be provided to retail investors in the United States or to the public in any jurisdiction where it would be unlawful to offer, to solicit an offer, or to sell such shares. This document is directed at professional/sophisticated investors and is for their use and information. The offering or sale of Fund shares may be restricted in certain jurisdictions. For information regarding jurisdictions in which the Funds are registered or passported, please contact your Voya sales representative. Fund shares may be sold on a private placement basis depending on the jurisdiction. This document should not be used or distributed in any jurisdiction, other than those in which the Funds are authorised, where authorisation for distribution is required. Voya is authorised by the Fund to facilitate the distribution of shares in certain jurisdictions through dealers, referral agents, sub-distributors, and other financial intermediaries. Any entity forwarding this material to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution.