|

|

The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. |

By Virginie Maisonneuve Global CIO, Equity, Allianz Global Investors; Jain Tushar, Senior Equity Analyst, Allianz Global Investors; Thomas Grillenberger, Deputy CIO Customized Equities, Allianz Global Investors.

Despite a rollercoaster few years in terms of global macroeconomic performance – and ongoing geopolitical uncertainty – one area which has proved particularly resilient is consumer spending. This has surprised some market observers, who feared that once “covid cheques” had run their course, consumer spending might be depressed.

While the picture is certainly uneven across geographies and sub-sectors, we expect this resilience and robustness to continue in the medium-term, at least, as the outlook is driven by several positive economic fundamentals, in the US especially. These include in particular high employment rates and the disinflationary trend that we have witnessed over the past six months. And the topic is a highly pertinent one: consumers are a crucial part of the overall economic picture across all major developed markets, with household consumption accounting for 53% of GDP in the Euro area, 60% in the UK and 67% in the US (data as of Q3 2023).

Strong fundamentals

A key factor supporting consumer behaviour over the last year or two has been elevated spending in the wake of the surge in savings seen over the pandemic – during the first quarter of 2020, households in the UK, US and eurozone held on to around a quarter of their disposable income.1However, this does not necessarily tell the whole story – despite the support from increased post-pandemic spending, the consumer backdrop has been more robust than many expected.

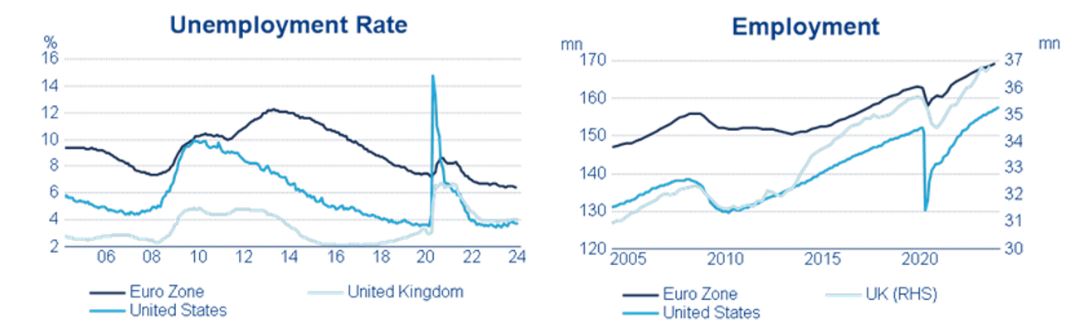

Two key factors can help explain this resilience. First, unemployment remains historically low, while employment levels are at a record high, as shown below.

Source: LSEG Datastream, 16. February 2024

Job markets across developed economies are not expected to deteriorate – consensus is for an increase in unemployment from 4.7% in 2023 to 5.1 % in 2024 across the G20 – while, anecdotally, employers continue to report difficulties in filling vacant positions.

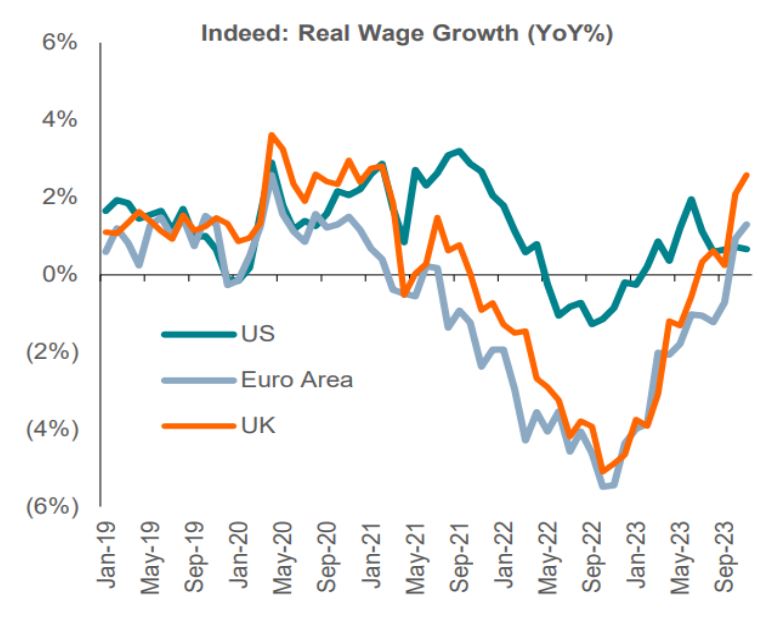

Linked to the promising employment outlook, has been strong real wage growth since mid 2023, driving disposable incomes, as inflation begins to come down rapidly. This should especially be beneficial for lower household incomes as it reduces the burden of higher inflation driven change in spending pattern.

Source: Indeed, Datastream, BNP Paribas Exane estimates

Indeed, the disposable incomes of households in the euro area are expected to grow by around 4% in 2024. While this is, of course, being driven by the robust employment and wage picture described above, we also expect to see inflation in fixed household expenditures drop from 5% in 2023 to 2% in 2024, leaving households with almost 6% more money to spend on discretionary items or save.2

In addition the disinflationary trends recorded globally in the past six months are also a factor transferring purchasing power back to consumers. Households have already started to feel the relief from lower electricity and petrol prices, whereas food inflation, while decelerating, has so far proven to be more sticky.

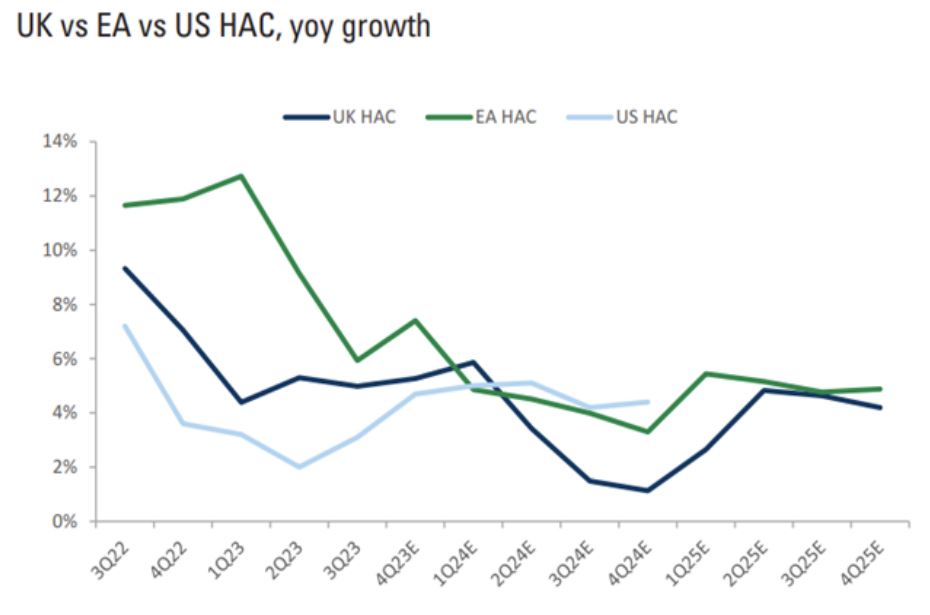

Source: LSEG Datastream, 16. February 2024

Historically, there has been a strong correlation between growth in household available cashflow (HAC) and retail sales, and the picture is therefore bright for continued strength in this sector. We expect HAC growth in the euro area to be particularly strong over the coming period.

Source: ONS, Bank of England, Eurostat, Goldman Sachs Global Investment Research

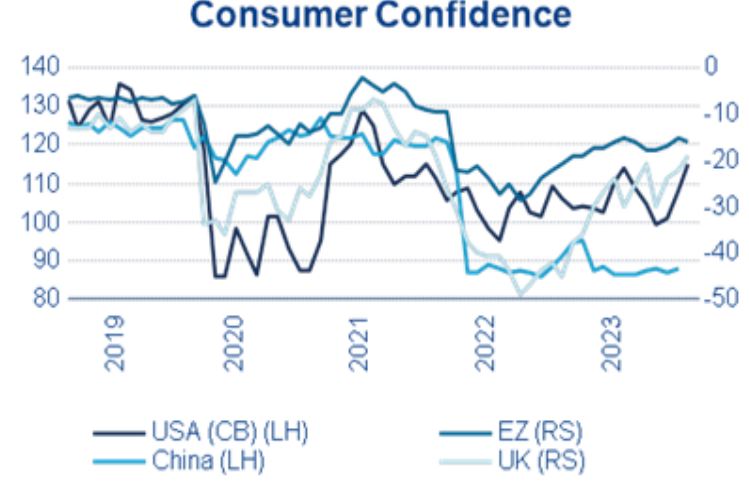

While not the only determinant, this improving outlook for households feeds into, and is evidenced by, improving consumer sentiment across major markets – though this, of course, is still recovering from very depressed post-pandemic levels.

Source: LSEG Datastream, 16. February 2024

These headline figures do not, of course, necessarily show the whole story in terms of the pressures on spending experienced by lower income households, yet the impact of instability on aspirational spenders has not been as severe as feared, while top level customers have continued to do enough to maintain positive momentum and market growth.3 Indeed, we expect that continued real wage growth in 2024 will lead to an easing of pressure on lower income households in developed markets.

One positive signal in this respect has been the outperformance of consumer discretionary stocks, compared to consumer staples, as illustrated below. Spending on experiences – for instance, travel and restaurants – has led to strong performance in this sector, while staples have seen inflation put a drag on volume growth.

It should also be noted that this consumer recovery has been uneven across geographies, with the US leading the way and China currently lagging.

Caveat emptor: being selective will be key for investors

Given these positive fundamentals, we expect the consumer sector to remain resilient in 2024, despite overall growth being set to fall. It is possible that 2024 will be split into two halves, with potentially higher volatility in H2 driven by waning excess savings and elections in both Europe and the US. However, these headwinds will potentially be offset by falling rates and continued growth in real wages.

We also expect the continuation of a long-term bifurcation among consumers and, as a consequence, consumer goods companies’ operating performance. Companies catering to a wealthier clientele like those selling luxury goods are likely to carry on doing well, not least as stock markets continue to create a positive wealth effect. On the other hand, companies offering attractive value propositions to lower-income households are also likely to prosper, and should see an incremental tailwind as their customers’ spending is bound to benefit most from strong wage growth, given a much higher proportion of income spent on consumption. With the former segment’s valuation reflecting its strong fundamentals, many stocks from the latter camp and those which were most impacted by the economic slow-down and higher rates (e.g. apparel or auto) might offer higher upside in the near- to medium-term.

In terms of specific sectors within the above-mentioned camps, we prefer leading companies within travel and leisure sector as well as restaurants who should be able to capture the demand as well as increase in the market share. Health and wellness trends and sporting events such as the 2024 Summer Olympics in Paris should benefit the sportwear segment in combination with a clear inventory position globally this year. High end luxury and beauty sector should remain resilient even in a slow growing global environment.

The overall backdrop for the consumer sector thus continues to look positive, but investors should expect a significant diversion in outcomes between sub-sectors and companies. The old adage “caveat emptor” applies to shoppers and stock selectors alike; investors should thus carefully select those companies and sectors that stand to benefit the most in the current disinflationary environment.