The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

As the German government plans a huge ramp-up in spending in 2026, we expect a steepening in the Bund yield curve and, in equities, a boost to sectors tied to public spending, such as healthcare, infrastructure, and defence.

Key takeaways

- Euro zone fiscal policy is set to loosen modestly in 2026, led by Germany’s historic spending push.

- Germany’s planned deficit of 4.75% of GDP implies the largest fiscal stimulus since the 1970s.

- Amid a diverging fiscal path, most other member states plan to cut spending or keep it in line with 2025, with Greece the only other notable source of stimulus.

- Execution risks remain high, but markets may respond with a steeper yield curve, tighter spreads, and a stronger euro.

Most euro zone member states have submitted their draft budgetary plans (DBPs) for 2026 to the EU Commission. These allow (1) a forward look at the fiscal impact on the economy next year, and (2) a backward look at budget execution to gauge the reliability of the plans announced.

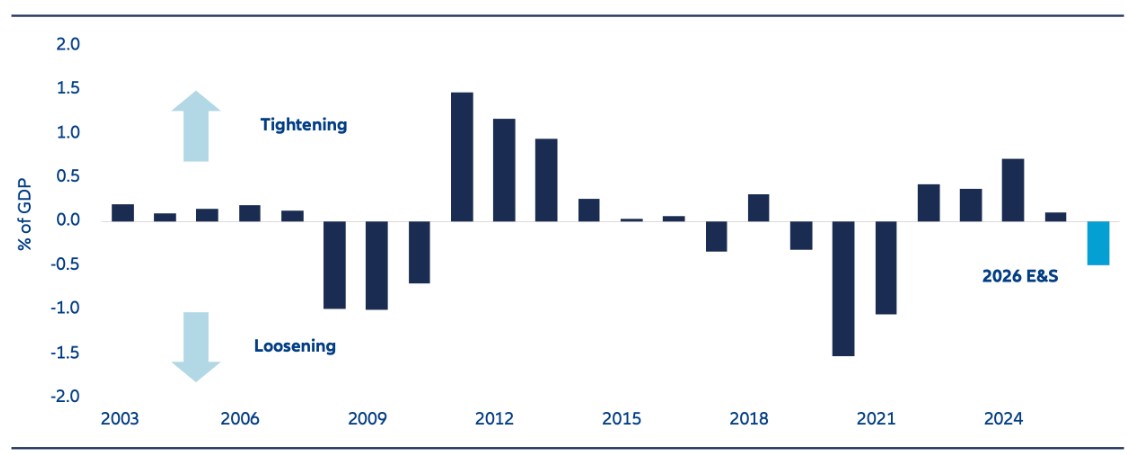

Overall, the submitted national budgets suggest a modest 0.3% of gross domestic product (GDP) widening in the structural general government balance. That would mark the first loosening of the fiscal stance – via raising spending and/or cutting taxes since 2021 (see Exhibit 1). EU-funded spending – especially from the Recovery and Resilience Facility (RRF) – likely boosts this impulse to 0.5% of GDP. Combined with 200 basis points of European Central Bank (ECB) rate cuts since 2024, the economy looks set for the most robust monetary-fiscal tailwind outside a major recession in decades (only 2017 comes close).

Sources: OECD and AllianzGI Economics & Strategy (E&S) (Data as of 17 Oct 2025)

Germany: can the government deliver on its fiscal plans?

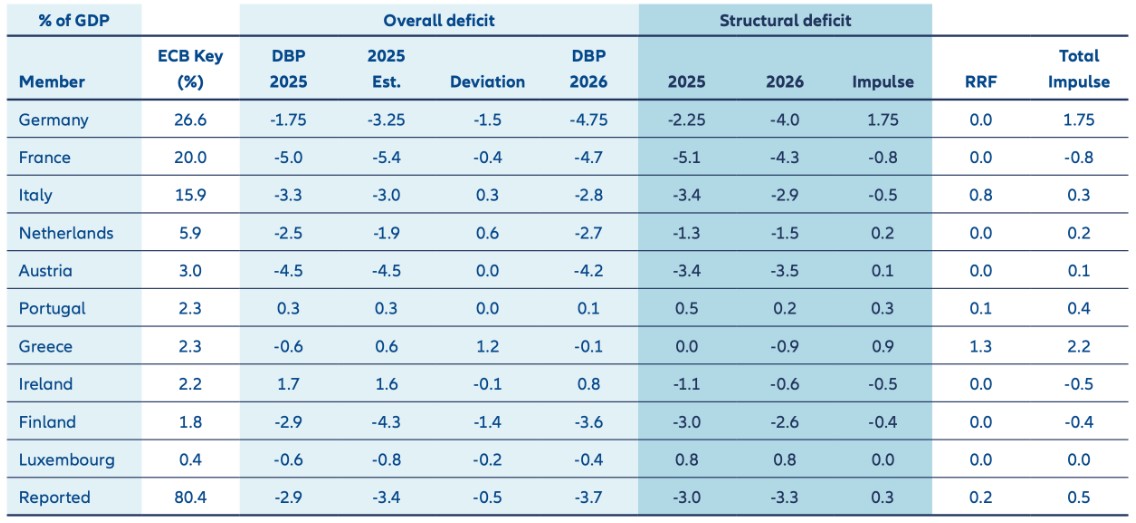

The largest fiscal impulse by far comes from Germany, where the government plans to widen the budget deficit to 4.75% of GDP in 2026 – the largest since 1975 (excluding the technical one-off deficit of 9.4% of GDP in 1995). Since no recession is associated with the deficit, this implies a structural widening of 1.75% of GDP.

We’re sceptical about Germany’s ability to deliver, given that the fiscal easing is entirely driven by government spending increases. Historical precedent, bureaucratic constraints, and limited capacity in the construction and defence sectors all suggest the bulk of the spending will occur in the latter part of the year.

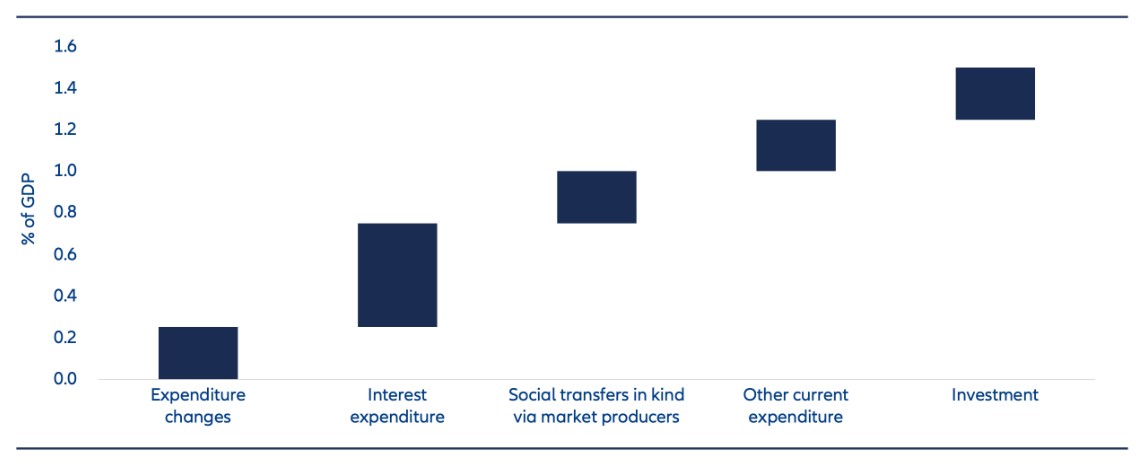

However, the largest component of the spending increase – 0.5 percentage points of GDP – is “social transfers in kind via market producers”, typically representing healthcare spending, which should be easier to implement (see Exhibit 2). In contrast, defence spending accounts for less than 0.5 percentage points, and public investment (including defence investment) for only 0.25 percentage points of the 1.5% of GDP deficit widening. Therefore, we should probably pencil in a deficit well above 4% of GDP – more than previously expected.

The focus on healthcare may also help explain the relatively low multiplier the government appears to be assuming, with GDP growth accelerating only to 1% next year.

Sources: German Finance Ministry DBP 2026 and AllianzGI E&S

Rest of the euro zone: risks to France’s spending plans and spending relief for Italy

The rest of Europe is not following Germany’s example of higher spending. Excluding Germany, euro area governments plan a modest cumulative fiscal tightening of 0.2% of GDP before Next Generation EU (NGEU)1 spending. Apart from Germany, only Greece is planning a significant stimulus (0.9% of GDP plus 1.3% of GDP from NGEU).

France foresees a 0.8% tightening – clearly subject to risk in the ongoing negotiations of Prime Minister Sébastien Lecornu’s government; even 0.5% might be optimistic. Italy plans a 0.5% of GDP cut, but this should be more than offset by a 0.8% of GDP increase in Recovery and Resilience Facility (RRF)2 spending. Ireland and Finland are also planning moderate tightening. In most other countries, fiscal policy is expected to be neutral in 2026. We are assuming a neutral stance from Spain, which has so far not submitted a draft budgetary plan and is widely expected to roll over the existing budget for another year and rely on NGEU spending.

Execution of budget plans slipped somewhat this year in Europe, at least compared to government projections in their draft budgets for 2025. The largest deviations between governments’ latest 2024 budget estimates and last year’s draft budgets occurred in Germany (-1.5% of GDP) and Finland (-1.4%). For Finland, this could mean a return to the EU’s Excessive Deficit Procedure (EDP)3, where fellow core-country Austria looks set to remain with deficits of more than 4% of GDP.

Italy and Greece outperformed their targets by 0.3% and 1.2% of GDP, respectively. This discipline could be rewarded by rating agencies and financial markets. Crucially, Italy looks set to comply with the 3% of GDP Maastricht criterion already in 2024, one year earlier than expected. That should allow Italy to exit the EDP, which in turn would enable it to activate the EU’s national “escape clause” and exempt 1.5% of GDP in defence spending from the fiscal rules.

Sources: EU Commission and AllianzGI E&S

Market implications: steeper Bund yield curve, tighter spreads and boost for the euro

- Steeper curve – We think a modest loosening in fiscal policy should allow the Bund yield curve to remain steep. We expect the yield curve to steepen even further if the ECB cuts interest rates again.

- Tighter spreads – Fiscal easing in Germany, a likely slippage in fiscal tightening in France, as well as sustained large deficits in Finland and Austria, will likely keep core yields under pressure and point to a tight spread environment.

- Peripheral upgrades – The former crisis countries – Italy, Spain, Portugal, and Greece – continue to build market confidence through stronger growth, conservative budgets, and disciplined execution.

- Support for the euro – Germany’s fiscal expansion, combined with narrowing spreads in the periphery countries, should provide a structural support for the euro.

- Tailwinds for equities – Sectors tied to public spending – particularly healthcare, infrastructure, and defence – stand to benefit, with small caps typically the beneficiaries of a cyclically improving environment. Banks in general also tend to benefit from the early stages of a cyclical upswing, while banks in periphery countries also benefit from their exposure to higher sovereign credit quality.