The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

Key takeaways

- Equity markets enjoyed strong performance so far in 2025, powering through headwinds ranging from tariffs, deteriorating fiscal positions, and geopolitics. Yet the rally in the gold price and the strong decline of the USD suggest that investors remain wary of risks.

- The current earnings season in Europe will likely not be a turning point for profit growth. However, as the focus shifts to 2026, there is rising optimism on the back of a cyclical recovery, accommodative monetary policy and incremental fiscal stimulus from Germany. This should at least momentarily reduce the growth gap to the U.S., allowing for the further outperformance of European stocks.

- The EU Savings and Investment Union is becoming increasingly well-defined and has the potential to provide sustained support for European equity markets.

Strong market performance in 2025

2025 is shaping up to be strong year for equity markets, taking in its stride headwinds from rising trade frictions and geopolitical risk. At the time of writing, the eurodenominated Stoxx 600 has gained 13% ytd, while USDdenominated MSCI World, S&P 500, and MSCI Emerging Markets rose by 19%, 17%, and 30%, respectively. From the perspective of a European investor, however, returns generated from outside of the home market were dragged down by c. 12% due to euro appreciation against the USD, so on comparable currency European and Emerging Market stocks are the clear outperformers this year.

The strong equity market performance does not mean that all risks have subsided, indeed there are signs that investors have some concerns on the global outlook. Gold, the eternal safe haven, is on an epic rally having returned more than 50% (in USD) over the course of the year. This has been driven by central banks increasing diversification away from US Dollar based assets amid rising worries about the sustainability of the US debt trajectory, upside risks to the US inflation outlook as the Fed resumes its rate cutting cycle, and safeguarding against rising geopolitical risks. The oil price on the other hand continues its downward drift reflecting rising supply as OPEC+ has started to increase output quotas but also lingering question marks about the strength of the global economy.

So far economies across the world appear to be able absorb the tariffs imposed by U.S. President Donald Trump without too much disruption. Yet despite agreements now in place with most major economic blocs, uncertainty about global trade policy amid the mercurial policy setting of the U.S. administration continues to persist and will increasingly weigh on the economic outlook of both of the U.S. and its trade partners the longer it last. In the near to medium-term we remain constructive on the outlook for European equities as we observe an improving outlook for corporate earnings as forward-looking indicators such as PMIs continue to trend positively underpinned by accommodative monetary policy and fiscal support, foremost in Germany. Any pullback should therefore be used as a buying opportunity.

2026 to be a step change in European earnings growth

We are in the midst of the earnings season – more than 50% of the Stoxx 600 will have reported by the end of October – and corporate results have been mixed so far. Consensus for Q3 earnings have been gradually revised downwards over the past 3 months and are expected to be slightly below last year’s level. This appears to set a relatively low bar to beat. Yet we are not convinced that the headwind from the weaker U.S. Dollar is fully reflected in the analyst forecasts yet, with roughly 25% of the revenues of European large caps generated in the U.S. In addition, European companies have highlighted that working through the implications of the various U.S. tariff imposed on them could push back revenues amid delayed decision making.

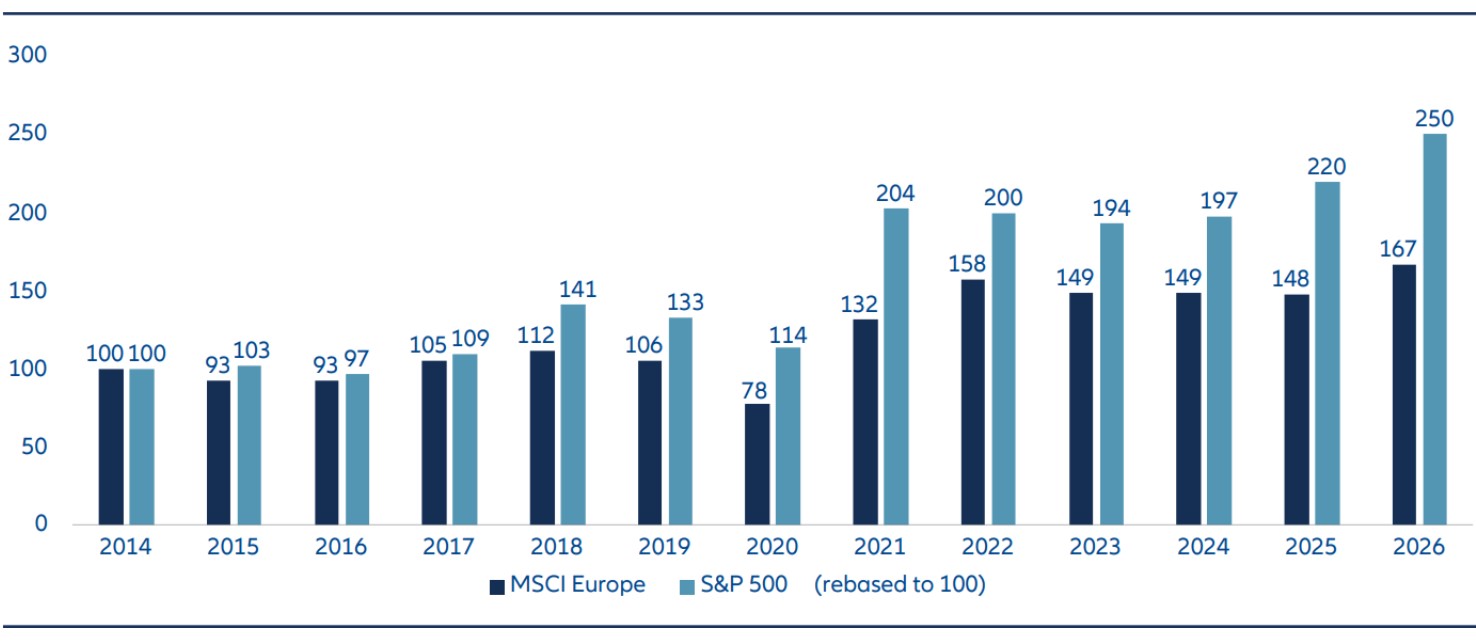

Yet as we approach the end of the year, we would argue that the positive expectations for 2026 are more important. Profit growth of Stoxx 600 members is forecasted to accelerate to 12% as currency headwinds fade out, negative impact from tariffs diminishes as companies adjust, and the macro-economic environment improves. Importantly, this will meaningfully reduce the growth gap to the U.S. equities – S&P 500 earnings growth is projected to be 14% – which has been a key driver behind the outperformance of US equities compared to European equities over recent years. We note that due to the outsized contribution of the Magnificent-7 to both earnings growth and index level returns, the trajectory of AI related spending will remain a key determinant for the US equity market.

Source: Datastream as of 24 October 2025. Past performance is not indicative of future performance.

High catch-up potential with the US market

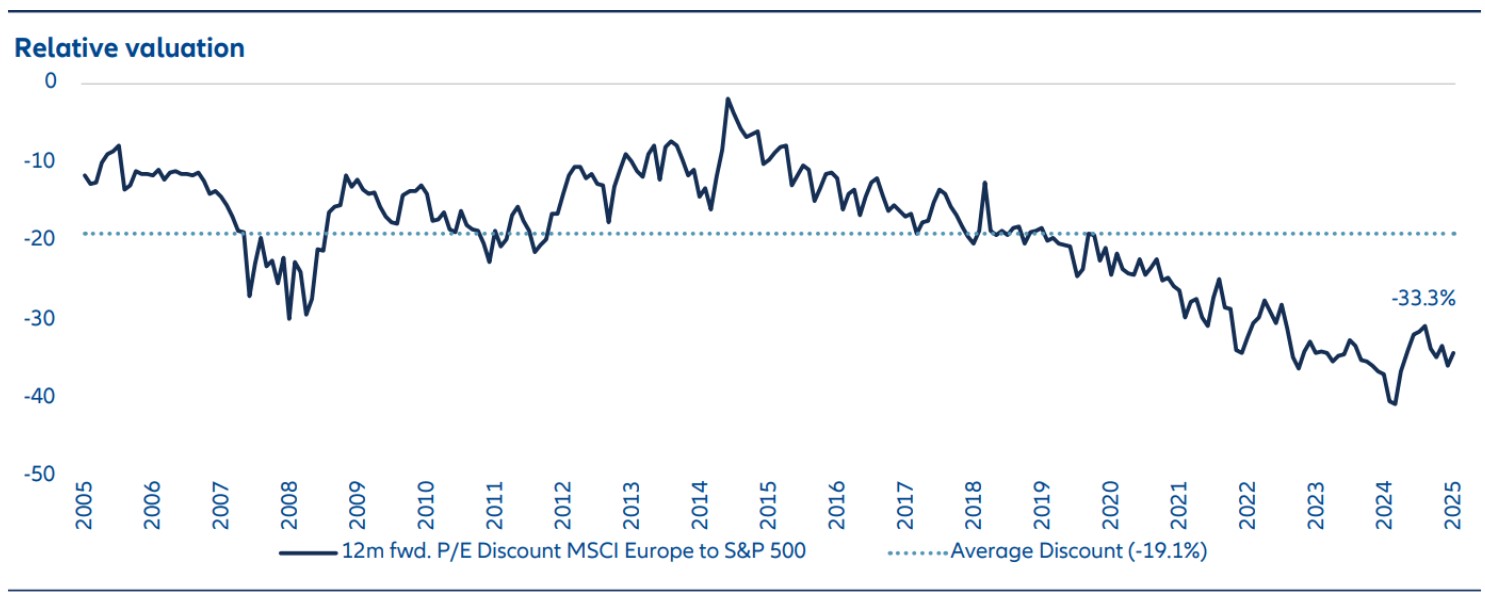

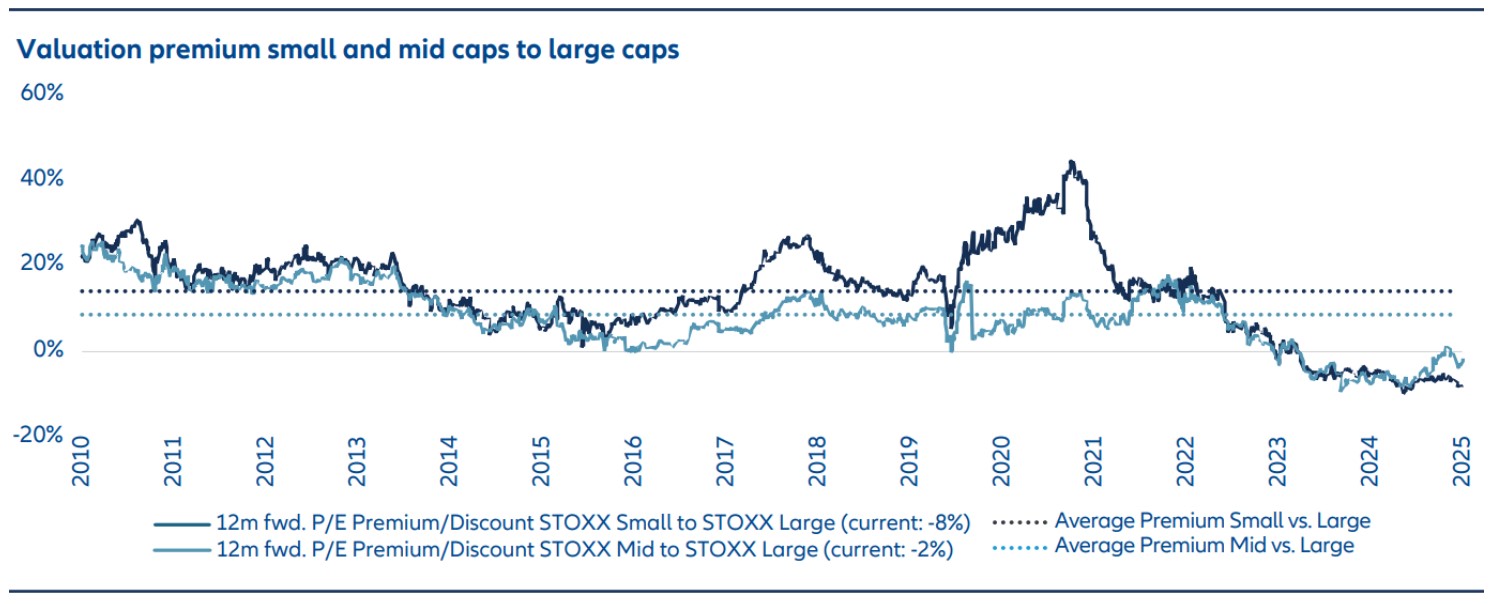

Despite European equities having outperformed the U.S. counterparts by c. 11 percentage points this year (in comparable currency) and not being cheap in an historic context anymore, the valuation gap remains compelling and suggests further upside as the growth gap between the two regions narrows. Looking out 12 months, the MSCI Europe trades at a P/E multiple of 15.1x compared to 22.6x in the U.S. This resulting 33% discount is significantly wider than the 19% average overserved over the past 20 years and remains meaningful even when adjusting for differences in the sector composition of the two markets. Within Europe, we see a particularly strong valuation argument for small and mid cap stocks, as the historic premium based on a structurally better growth outlook has flipped into a discount after the pandemic. Fundamentally, smaller corporates benefit the most from lower interest rates and are more domestically oriented, reducing the impact from currency and tariff headwinds.

Positioning add another leg to the investment case for European equities. While investors initially rotated out of the U.S. into European markets post “liberation day” due to a perceived decline of “U.S. exceptionalism”, this trend quickly faded. Positioning in European stocks remains relatively low in a longer-term context, so a visible improvement in the underlying economy or reduction in geopolitical overhang like progress on resolving the conflict in Ukraine should act as a positive catalyst for the European stock market.

Source: LSEG Datastream as of 24 October 2025

Source: LSEG Datastream as of 24 October 2025

The EU Savings and Investment Union

While Europe has a strong corporate sector and other key ingredients for innovation and growth, there is room for improvement to create a stronger equity ecosystem to fund innovation and growth with risk capital. Strong innovation capabilities both in the academic and corporate sectors need equity capital to scale.

Start-ups rely on venture capital finding and VCs need viable and reliable exit opportunities – including IPOs. Since 2020, IPO activity in US was significantly higher than in the EU by a factor of 3.5, while the US accounts for more than 70% of MSCI World, market cap weighted, but only around 48% of MSCI World GDP weighted. EU member states are underrepresented in MSCI World (market cap weighted). These figures are good indicators of to what extent a reliable “equity ecosystem” could help to mobilize the capital that is required to fund innovation and growth.

This challenge is widely recognized but not simple to solve. However, the EU has initiated a programme called the EU savings and investment, the EU SIU. This has the potential to be a bold strategy to enable European (financial) sovereignty.

Key elements should include the following aims:

- Significantly higher retail participation via simple, tax efficient savings and investment accounts, similar to the current Swedish model.

- Ensuring institutional investors can invest in both public and private equity.

- “Smart” public private partnerships to mobilize capital.

- A more entrepreneur friendly tax regime.

With bold action, the EU can ignite growth and create wealth for a broader part of its population. Since 2020, Swedish IPOs have around USD 19.9bn Equity (213 transactions), Germany amounts to USD 25bn (36 transactions, with Porsche AG 9bn a heavyweight in the statistics), while France managed just USD 5bn (62 transactions). So the “Swedish model” has not only contributed to the welfare of the Swedish Population, but has also contributed significantly to a vibrant equity ecosystem.

There are currently many discussions around the EU SIU and key challenges are the alignment with existing pensions schemes in member states, taxes, and various other frameworks that remain in the purview of national member states. In the meantime, the EU has proposed that, as first steps, the programme should address financial literacy and that EU member states should introduce savings and investment accounts with some key features such as tax incentives, simplified processes, a broad investment offering, and a variety of potential providers.

What will be the impact of this for European equity markets and innovation capabilities? It will represent a structural, long-term tailwind – difficult to quantify, at this stage, but certainly a potential opportunity that investors should be mindful of.