The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

By Anand Gupta, CFA, Portfolio Manager, Allianz Global Investors; Sarah Lien, Senior Product Specialist, Allianz Global Investors.

While the fundamental case for investing in Indian equities remains strong – based on a robust macroeconomic backdrop, a powerful demographic dividend, and rapid technology adoption – questions around market valuations remain. Multiples such as price-to-earnings (P/E) and price-to-book (P/B) look expensive relative to both other emerging equity markets and India’s own history. While the MSCI India Index has been trading at a valuation premium for several years, this spread has continued to widen, not least as other large markets like China have disappointed.

Behind the headline valuations, however, lie a number of dimensions that are contributing to India’s premium rating. In this analysis, we review the key valuation drivers and offer an assessment of their trajectories. Overall, our conclusion, is that Indian equity valuations are justified given superior earnings growth, cash flow and profitability, each of which we expect to be maintained in the coming years.

India’s demographic and technological edge

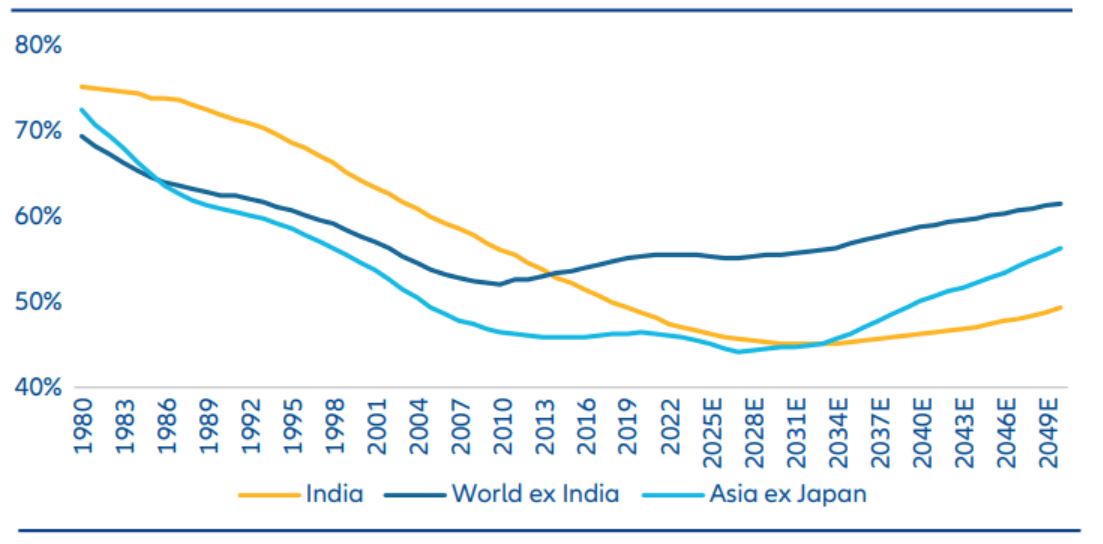

‘Terminal growth’ is a critical variable in stock valuation, especially when using discounted cash flow models, often serving as the linchpin for longterm projections. This growth rate is profoundly influenced by a country’s Sarah Lien Senior Product Specialist demographic trends, particularly the proportion of the working-age population (see also Figure 1 – Age Dependency Ratio). A higher share of working-age individuals tends to create a virtuous cycle of rising income, increased savings, and greater investment, all of which contribute to sustained economic expansion at the national level, and increased earnings at the corporate level. India stands out in this regard, boasting one of the lowest age dependency ratios globally, positioning its companies favourably in terms of strong terminal growth.

Moreover, India’s rapid technology adoption has significantly enhanced productivity across sectors. Over the past seven years, India has added over 500 million new internet subscribers, driving an unprecedented digital transformation. During this period, data costs have plummeted and are amongst the lowest globally, with a 5GB plan costing around USD 0.32 per month. Meanwhile, data usage per subscriber has skyrocketed.

These developments have fueled a leap in technological integration, enabling companies to scale efficiently and innovate, reinforcing their competitive advantage. While traditional economic measures like Gross Domestic Product (GDP) might not fully capture these gains, the impact becomes evident through the increasing market share of key players across various industries and a healthy pipeline of Indian businesses entering the market, both in the public and private spheres.

The combination of India’s favourable demographics and technological advancement provide a solid foundation for robust terminal growth. With this in mind, valuations imply that the future cash flows of Indian businesses will be well supported, in our view making India a compelling landscape for equity investors looking at the long-term.

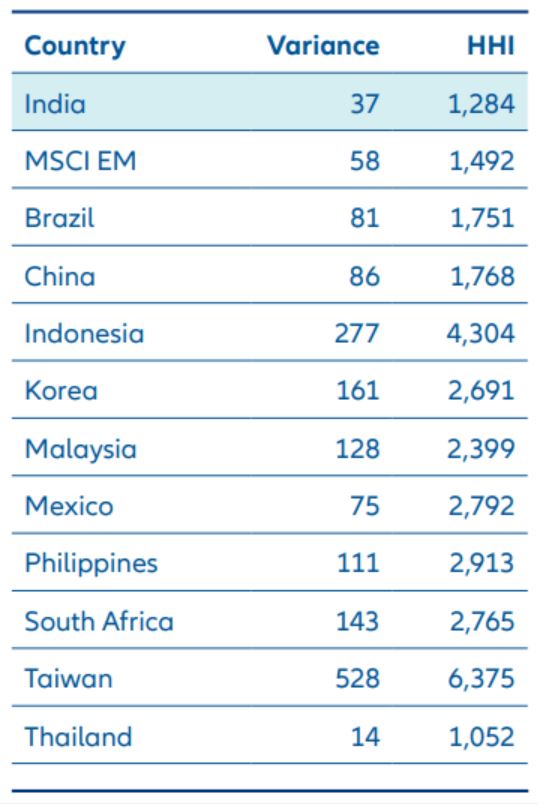

Wide sectoral representation within the Indian equity market offers active portfolio managers a vast opportunity set from which to select stocks and, importantly, a means to implement more nuanced and effective risk management strategies. By having access to a variety of sectors that perform differently across economic cycles, managers can construct portfolios that not only capitalize on growth opportunities but also mitigate performance volatility by gaining exposure to more defensive areas. The data clearly reflects this advantage: India exhibits significantly lower variance and a lower Herfindahl-Hirschman Index (HHI) (a measure of diversification, with lower figures denoting more competitive markets) compared to other major emerging markets, underscoring its superior diversification.

Source: Morgan Stanley, The New India: Why This Is India’s Decade (31 October 2022). The age dependency ratio is calculated as the sum of young (< 15 years old) and elderly population (> age 65) divided by the working age population.

Diversification – A deep and wide pool of lowly correlated stocks

India stands out as one of the most diversified markets within the emerging economies, offering investors a broad spectrum of opportunities with low correlation across sectors. This diversity spans traditional industries like agriculture and manufacturing, alongside rapidly expanding sectors such as technology, pharmaceuticals, and financial services. The ongoing structural shift towards manufacturing, driven by government incentives like “Make in India” and substantial infrastructure investments, further amplifies this diversification.

Source: Source: Morgan Stanley, Allianz Global Investors, 26 August 2024

Variance: Represents the dispersion of sector weights; lower variance indicates greater diversity

HHI: Herfindahl-Hirschman Index, where a lower HHI indicates higher diversification with more equally distributed sector weights.

In practical terms, this means that investors in Indian equities benefit from a more balanced market, where returns can be generated across a range of sectors with reduced overall portfolio risk. As global markets become increasingly interconnected, we believe that India’s diversified sector mix offers an attractive proposition for those seeking to optimize returns while minimizing exposure to sector-specific downturns.

High Quality Growth – The Strength of India’s Services and Consumer Sectors

India’s economic growth is distinctively characterized by sizeable services and consumer sectors, which sets it apart from other emerging markets. India has fostered an environment that grants pricing freedom to private enterprises, enabling them to develop innovative business models and develop competitive advantages through open market competition. This freedom, combined with lower reliance on state-owned enterprises and a reduced focus on the materials sector, has contributed to the development of a diversified and resilient economy.

The services sector, encompassing information technology, financial services, healthcare, and professional services, plays a pivotal role in driving India’s GDP, contributing over 55% to the national output. This sector’s rapid expansion is supported by India’s strong intellectual capital and global integration, particularly in IT services, where it accounts for approximately 55% of the global outsourcing market.

Furthermore, India’s consumer market is poised for extraordinary growth, with projections indicating it will more than double by 2031 to reach USD 5.2 trillion.1 This forecasted surge is propelled by rising household incomes, urbanization, and a burgeoning middle class, leading to increased demand for premium consumer goods and services. The country’s young, ambitious. and dynamic population, with a median age of just 28 years, is further fueling this growth, signaling sustained consumption over the coming decades.

In contrast to many other emerging markets, where growth is often heavily reliant on natural resources and/or state-driven investments, India’s growth trajectory is anchored in its vibrant private sector and entrepreneurial economy. The global shift towards knowledgebased industries places India in an advantageous position, with its service-oriented economy providing a strong foundation for long-term, high-quality growth.

India’s distinctive blend of democratic governance, economic liberalization, and emphasis on services and consumer sectors not only enhances the quality of its equities but also its scope for sustained economic expansion that is less vulnerable to the volatility that often plagues more resource-dependent economies.

High ROE and EPS Growth with Lower Dilution

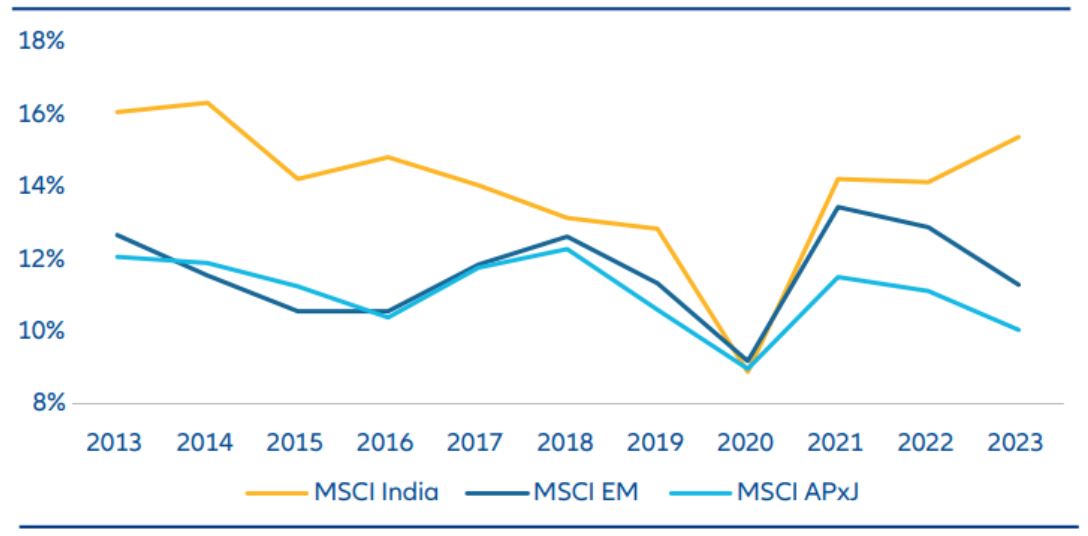

All of these factors – India’s favourable demographics, rapid technological adoption, sectoral diversification, and the strength of its services and consumer sectors – are validated by the consistent ability of Indian companies to generate high returns on equity (ROE) and sustained growth. These robust fundamentals have upheld the ability of Indian corporates to deliver superior performance compared to other emerging markets historically and further support the long-term valuation profile of Indian equities.

Source: Goldman Sachs/Factset

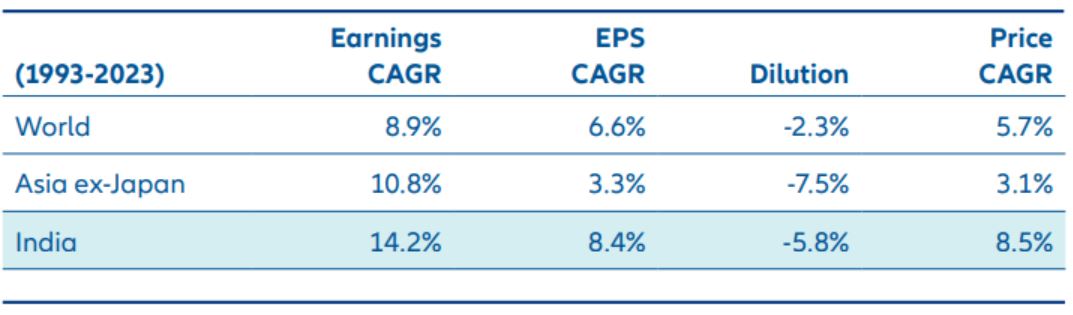

Another qualitative factor that enhances India’s equity valuation is its track record of not only achieving higher earnings growth but also demonstrating superior earnings per share (EPS) growth due to lower dilution effects from the requirement to issue additional equity. Over the past 30 years, studies have consistently shown that India has experienced significantly lower equity dilution compared to many of its developing counterparts in Asia. This lower dilution is largely attributable to India’s growth being driven by capital-light sectors like services and consumer industries, which have a reduced need for intensive new capital. Additionally, the strategic focus on optimal capital allocation within Indian firms further mitigates the risk of dilution, distinguishing India from other markets where growth is heavily reliant on capital-intensive sectors.

Source: BofA Predictive Analytics, MSCI, FactSet

Conclusion: India’s strong fundamentals support valuation premium

In summary, while some investors might feel queasy about the high valuations in the Indian stock markets, a country that consistently demonstrates a sustained growth trajectory, combined with highquality earnings that translate into superior EPS and ROE, is in our view well-positioned to sustain a higher price-to-earnings (P/E) ratio over time. The opportunity to invest in a diversified market with various levers for growth and a budding consumer market only adds to the appeal. While India equity valuations are higher than other emerging markets, in our view this is justified given the strength of the underlying business fundamentals, which we believe suggests corporates should continue to deliver superior earnings and cash flows.