We believe bonds will help diversify stock allocations as we return to a more normal rate and inflation environment.

Quick take

U.S. avoids slowdown (for now)

- Not only has the U.S. avoided a widely anticipated recession (amid historically aggressive increases in interest rates), but the economy has been running above potential growth. However, as higher rates have more time to seep into the system, we think growth comes down meaningfully—but without a sustained contraction in output.

- Inflation remains in focus, and we think it will continue to decelerate despite higher energy prices.

- The labor market is cooling but not breaking. It typically takes 18–24 months after the beginning of a Fed tightening cycle for joblessness to increase. We just moved into this range.

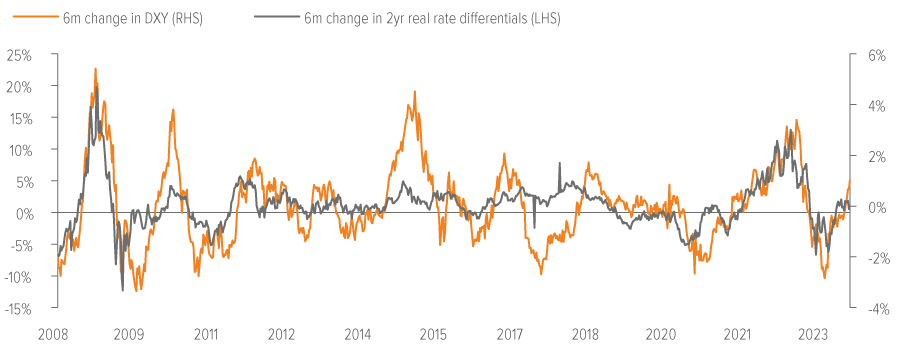

- The U.S. dollar should hold strong given favorable interest rate differentials and recent geopolitical shocks, due to its safe haven status in times of heightened stress and uncertainty.

U.S. equities over Europe, too soon for small caps

- We continue to prefer U.S. assets and have shifted to a modestly more defensive posture overall.

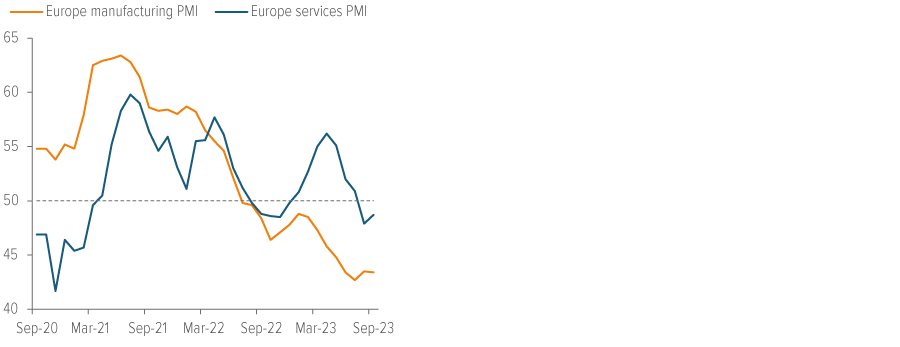

- We remain underweight Europe because of slowing macroeconomic momentum, exemplified by declining services and manufacturing PMIs, which we expect will lead to a markdown in corporate profits.

- China continues to disappoint. Although other emerging market (EM) countries have better near-term prospects, it’s difficult to be bullish on EM equities overall when China is dragging.

- Small caps tend to outperform during periods of expanding manufacturing activity, but until we gain confidence that manufacturing has bottomed, we remain neutral.

Bonds are back

- The current environment is favorable for bonds, as the Fed’s commitment to reducing growth to below trend should drive yields lower.

- We believe bonds will help diversify stock allocations as we return to a more normal rate and inflation environment.

Tactical indicators

Economic growth (slowing)

Despite better-than-expected growth this year, we anticipate a delayed slowdown as the impact of tightening money supplies is felt both domestically and abroad.

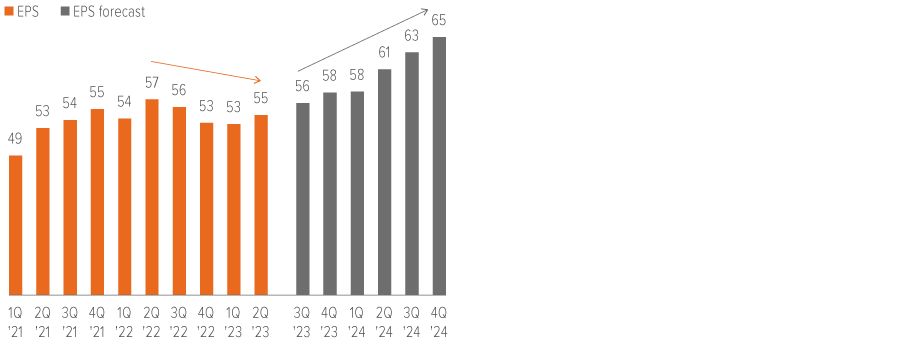

Fundamentals (neutral)

We believe that earnings have hit a low point and are poised for a significant upswing in the coming quarters. However, consensus earnings expectations may be overly optimistic, given the challenges of growth and contracting margins in a decelerating pricing environment.

Valuations (negative)

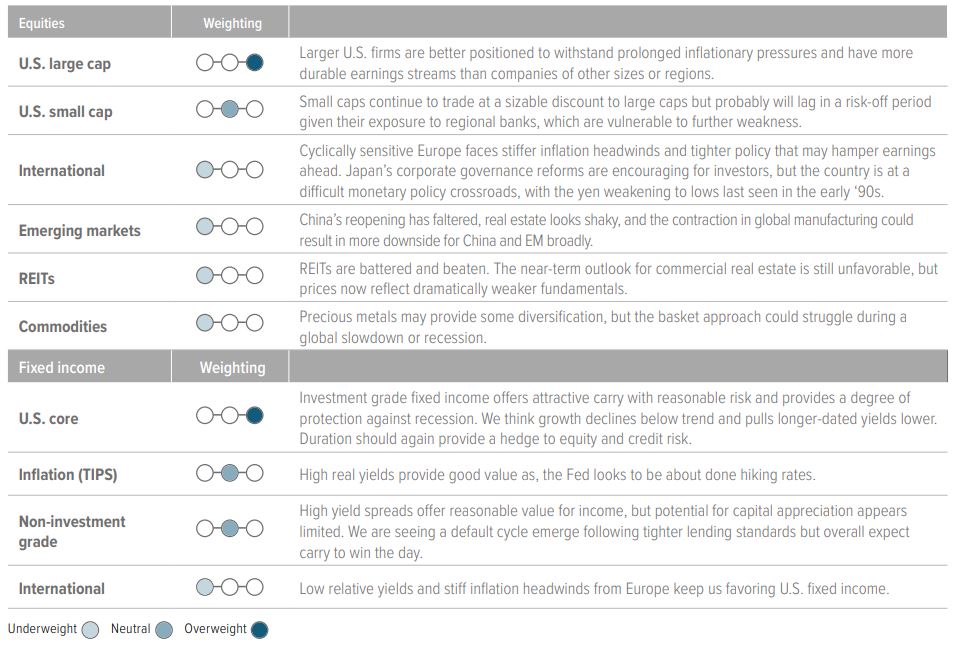

Forward U.S. equity earnings multiples are above their historical average and more expensive than in other regions. However, earnings multiples have decreased from their 2021 highs and appear to be at reasonable levels (Exhibit 1). The surge in real yields has made U.S. and global bonds more attractively priced. We see potential for both carry and capital appreciation in high-quality fixed income.

Sentiment (neutral)

The favorable positioning tailwinds we experienced in the first half of the year are behind us, which may result in volatile trading for the remainder of 2023. The selloff since August has alleviated the extreme overbought readings we observed in July.

As of 10/19/2023. Source: Bloomberg, J.P. Morgan, Voya IM.

Portfolio positioning

We think the earnings recession is over and profits are set to improve. However, overly optimistic expectations and a deteriorating growth outlook have us holding a defensive posture within equites and shifting more of our portfolios into bonds after the sharp rise in rates.

Investment outlook

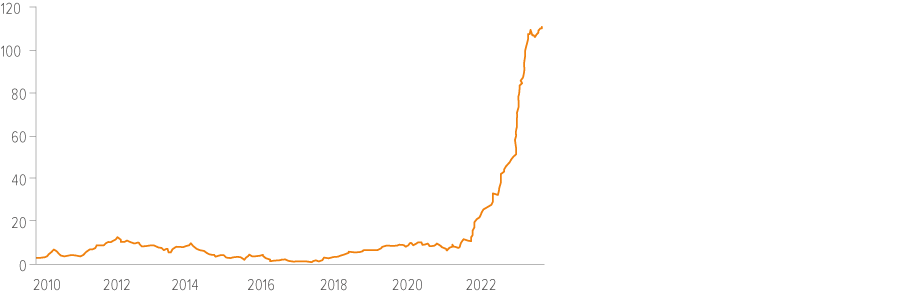

Not only has the U.S. avoided a widely anticipated recession amid a historically aggressive increase in interest rates, but the economy has been defying all expectations for growth. The economy proved to be less interest rate sensitive and more resilient than expected, and consumers and corporations locked in rates near historic lows. As a result, there’s been limited diffusion through the lending channel, which is how monetary policy influences economic activity. We think this is set to change as higher rates seep into the system. There have also been non-monetary offsets that are likely to fade, most notably supportive government spending. The Inflation Reduction Act’s open-ended 25% tax credit on semiconductor manufacturing sparked a boom in construction that is unlikely to be repeated or maintained (Exhibit 2).

As of 10/10/2023. Source: Census Bureau and S&P Global.

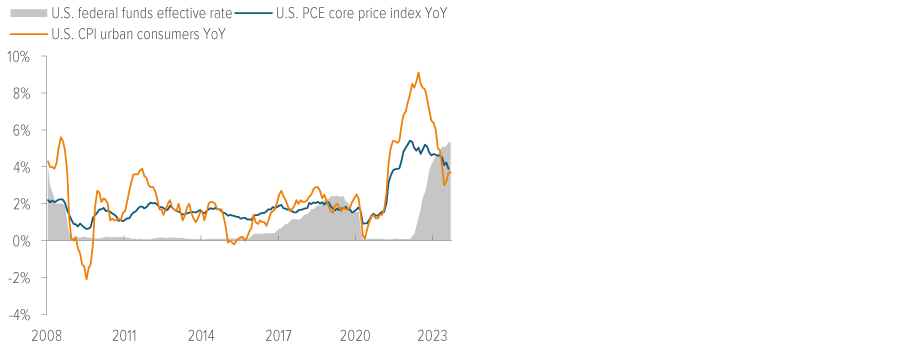

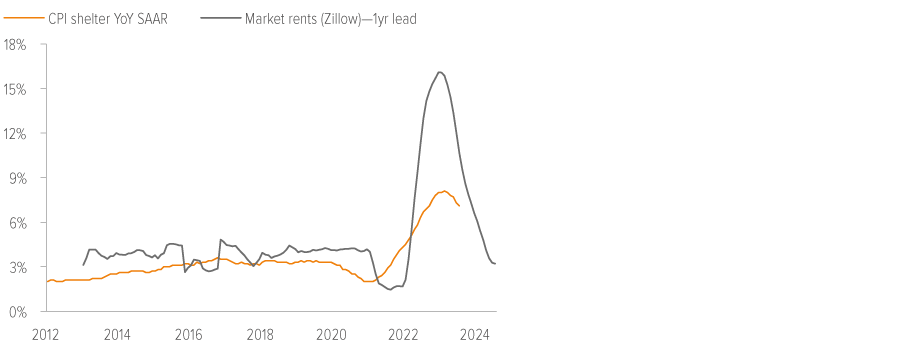

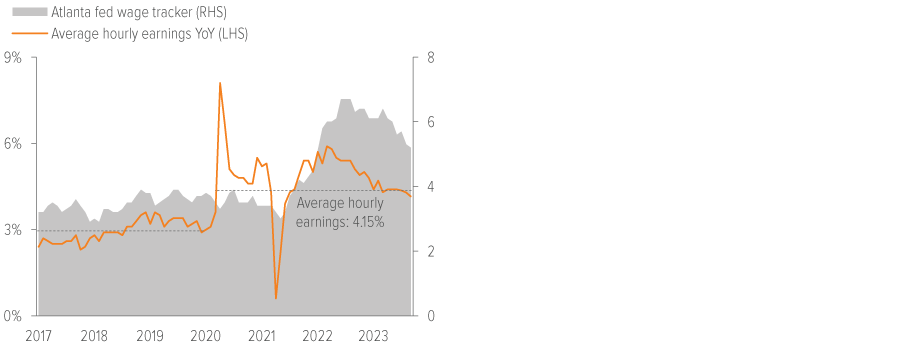

All eyes remain on inflation. Core personal consumption expenditure (a key Federal Reserve gauge of consumer prices) was up 3.9% year-over-year in August, continuing its deceleration from last year’s 5.6% cycle high (Exhibit 3). Most of the drop has come from the supply side, but we believe tighter monetary policy and lessening fiscal support will weigh on the demand side in the period ahead. Housing costs are high, with home affordability now below 2006 lows. But rent prices have dropped, which means there will be less inflation. Oil prices have climbed, mainly from Saudi/Russian strategies to curtail supply, pushing headline inflation up. The igniting of the Israel-Hamas conflict has the potential for significant further Middle East supply disruption. Nonetheless, the rise isn’t yet alarming, as it hasn’t translated into higher gas prices (given a big compression in refining margins) and is manageable relative to disposable income growth, which has been strong. Employment data is a more important factor for determining the course of inflation.

As of 10/16/23 (LHS) and 9/30/23 (RHS). Source: Bloomberg, Voya IM.

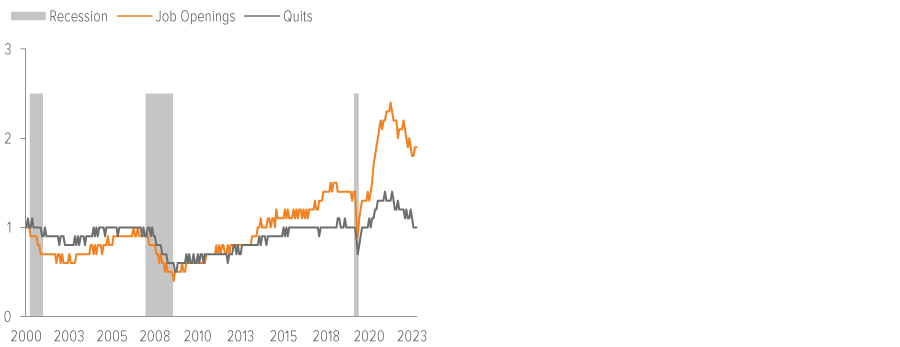

The labor market is cooling but not breaking. With the unemployment rate at 3.8%, labor markets have been strong, but job openings and quits have been trending down since March, suggesting a softening in the employment picture. While wages are declining, they are growing above inflation and are historically high. This suggests only a modest weakening in consumer buying power, but we think there is more to come (Exhibit 4). Recent labor union activities have garnered attention, but they represent only about 10% of the workforce.1 It typically takes 18–24 months after the beginning of a Fed tightening cycle for joblessness to increase. We just moved into this range.

As of 9/30/2023. Source: Bloomberg, Voya IM, Current Population Survey, Bureau of Labor Statistics, Federal Reserve Bank of Atlanta calculations. Job openings represented by the JOLTS index (JOLTTOTL). Quits represented by quits rate index (JOLTQUIS).

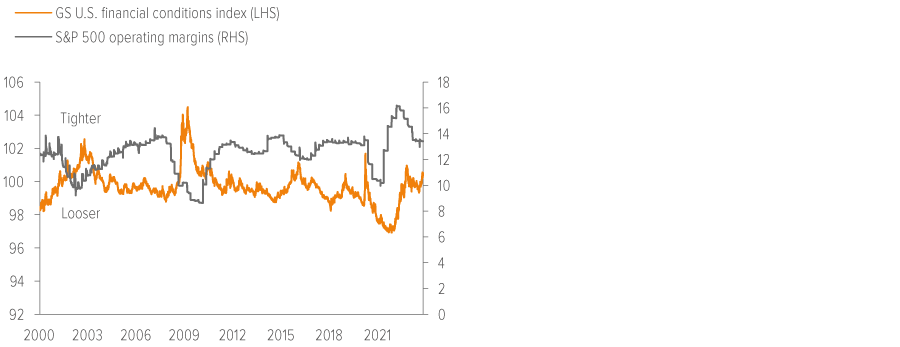

U.S. assets remain attractive. Despite some headwinds, the U.S. continues to offer a robust macroeconomic picture compared to other developed nations, particularly Europe. While we maintain a neutral stance on equities, we believe U.S. large cap stocks are best positioned to grind higher due to their more durable earnings streams than companies of other sizes or regions. We think earnings for S&P 500 companies have troughed and are set to enter a new phase of growth (Exhibit 5). However, earnings estimates are aggressive given what we believe will be slower economic growth in the next few quarters and margins that we believe will revert somewhat alongside tighter financial conditions. This keeps us neutral overall, with a more defensive tilt.

As of 10/16/2023. Source: FactSet, Bloomberg.

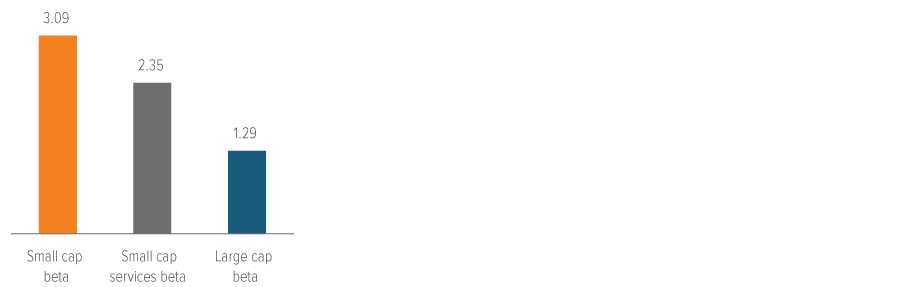

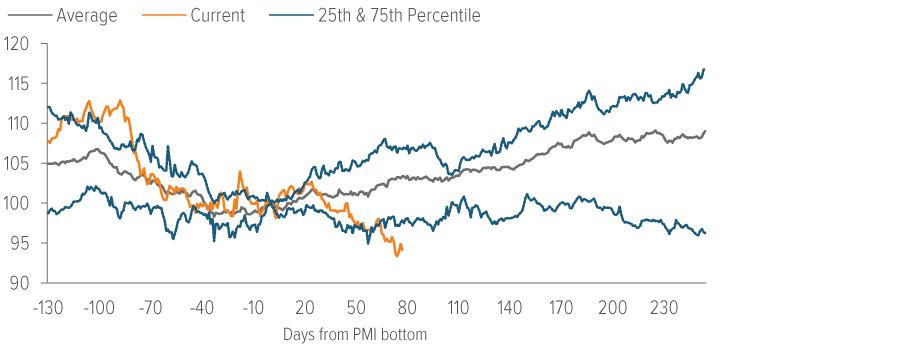

Small caps are cheap but vulnerable. Small cap companies have a higher proportion of debt that needs to be rolled over in the short term, as well as weaker interest coverage ratios compared to those of their large cap peers. Accordingly, this leaves small caps more exposed to rising rates. Small cap revenues have historically had nearly 2x the beta to nominal GDP of large cap revenues, so any slowing in growth will likely impact this cohort more. However, the beta to service sectors—where most of the future incremental slowdown is likely to occur—appears lower than that to GDP (Exhibit 6). Small caps tend to outperform during periods of expanding manufacturing activity (Exhibit 7); until we gain confidence that manufacturing has bottomed, we remain neutral.

As of 10/31/2023. Source: Bloomberg.

We’re cautious on Europe. European stocks ended last year and started this year with a bang, but we think they got ahead of themselves, as they are further behind the curve in their inflation fight. They also continue to contend with issues of the Eurozone structure. For example, having one monetary policy for the Eurozone and different fiscal policies at the country level is problematic (exemplified by Italy and France recently announcing generous new spending bills while the ECB struggles to withdraw stimulus). Europe’s slowing macro momentum—illustrated by contracting services and manufacturing PMIs (Exhibit 8)—should take a bite out of corporate profits.

China continues to disappoint. There was little (if any) reopening burst of activity, and economic growth is slowing, with retail sales, industrial production and fixed investment all coming in lower than expected. Exports have plunged (Exhibit 9), due in part to U.S. companies’ efforts to re-shore or move offshored manufacturing elsewhere. Furthermore, China’s real estate sector, their main growth engine, is in freefall (Exhibit 10), with multiple large property developers teetering on the edge of default. However, the country continues to make progress on the technological front (for example, semiconductor chips, electric vehicles, aerospace, etc.). While valuations are at deep discounts (and the government has signaled it may intervene with a stabilization fund to buy stocks), the outlook for Chinese equities remains uncertain. Although other EM countries have better near-term prospects, it’s difficult to be bullish on EM equities overall when China is lagging.

As of 9/30/2023. Source: Bloomberg.

As of 9/30/2023. Source: Bloomberg.

As of 10/13/2023. Source: Bloomberg.

The U.S. dollar should hold strong but be less of a headwind to emerging markets. Technicals suggest the modest retreat could continue in the near term, but the U.S. dollar (USD) will likely maintain an edge over a broad basket of currencies due to relative growth and real rate differentials (Exhibit 11). Recent geopolitical shocks and subsequent flights to the USD validate its safe haven status in times of heightened stress and uncertainty.

Bonds look increasingly attractive. The rapid rise in bond yields and the Fed’s commitment to reducing growth to below trend should drive yields lower as the economy weakens. Real 10-year yields are approaching 2.5%, and investment grade corporate bonds yield more than the earnings yield on large U.S. stocks. Amid these market conditions, fixed income investments have become more appealing. Furthermore, large corporate issuers are not showing signs of stress, as most treasurers front-loaded financing activities when rates were low.

As of 10/13/23. Source: Bloomberg, Voya IM. Note: DXY is an index of the U.S. dollar versus a trade-weighted basket of currencies. The 6m change in 2yr real rate differentials is the difference between U.S. 2-year real yields and a basket of 2-year real yields of countries that are major currency crosses in DXY (EUR, JPY, GBP and CAD), weighted according to the latest DXY weights and rescaled to 100.

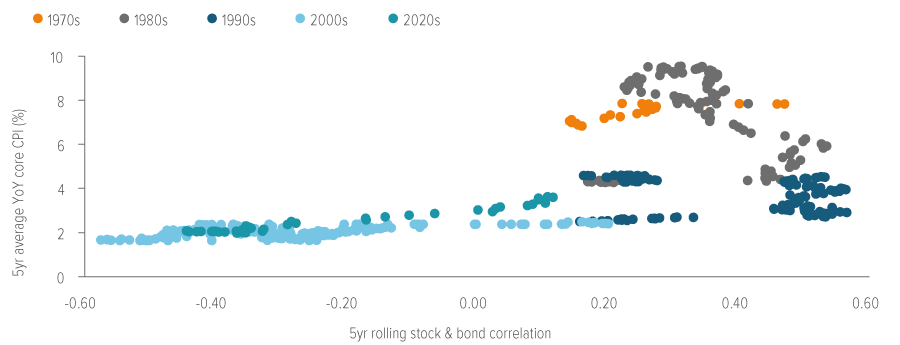

Diversification is not dead. Through the third quarter, stocks and bonds have declined in tandem, reminiscent of 2022, when both asset classes sold off significantly. While this environment is causing some investors to question the merits of a balanced portfolio, we believe bonds will help diversify stock allocations as we return to a more normal rate and inflation environment (Exhibit 12)

As of 9/30/2023. Source: Strategas, FactSet, Voya IM.

A note about risk Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. |