The race for superintelligence has triggered a spending boom on graphics chips, data centers, power supply and talent. Our panel discusses what it means for investors.

Artificial intelligence has been creeping into our lives for years, working behind the scenes to influence consumer choices, aid research and help management teams make better decisions. But as language models have become more capable, the expectations around them have skyrocketed and investment in AI infrastructure has surged, helping to lift U.S. equity markets to ever greater heights. Yet turning new technologies into profitable solutions often takes longer than expected. How sensitive is the AI spending spree to moments of disappointment? What does it mean for the economy and employment? Where will the power needed for the new data centers come from? And will new capabilities fundamentally change how portfolio managers make investment decisions? To answer these questions, we’ve gathered a panel whose expertise spans equity and fixed income research, AI-driven investing, private infrastructure and multi-asset strategy. You’ll come away with a better understanding of what’s real and what’s hype, what the potential pitfalls are, and where the hidden value lies. Please enjoy, and we look forward to continuing the conversation with you around this rapidly evolving topic. |

Macro: Achieving economies of hyperscale

Eric Stein: Why has AI investment suddenly accelerated? What changed?

Sebastian Thomas, CFA (Lead Portfolio Manager, Artificial Intelligence): We’re witnessing something akin to a modern-day Manhattan Project, with four or five companies spending feverishly in pursuit of artificial general intelligence (AGI). The belief is that as data volumes and compute power increase, we’ll get to a point where the computer has human-level intelligence across many domains of expertise. That theoretical possibility is driving the capex spend, because whoever achieves AGI first will be in control of maybe the most important technology in history.

At the same time, it’s unclear whether the current technological path they’re pursuing will get to AGI. Oppenheimer at least had a clear line of sight to what he was creating. AGI is more of a conceptual target. But what’s been unlocked so far is already having a profound impact on the global economy.

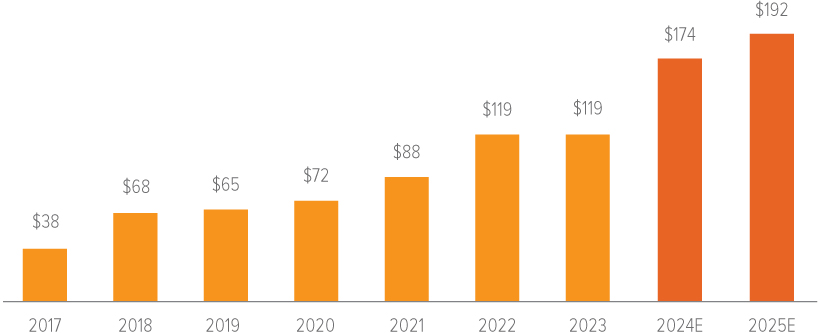

As of May 2024. Source: Bloomberg, Voya IM.

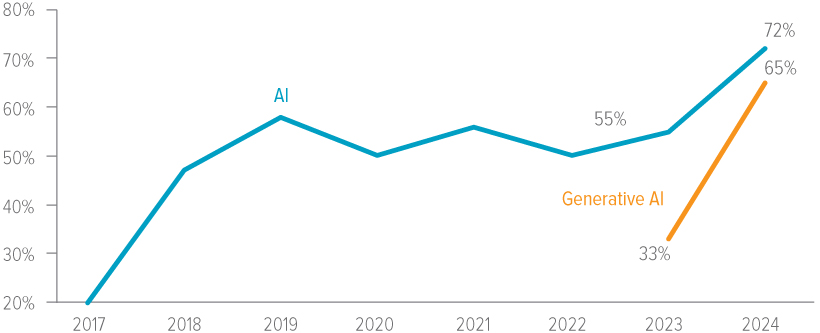

Kristy Finnegan, CFA (Co-head of Fundamental Equity Research): If 2023 was a year of discovery and experimentation, 2024 is when companies are starting to see real benefits. The breakthroughs in AI are coming as a result of step-change improvements in compute power (via Nvidia GPUs), data management (enabled by the shift to the cloud) and algorithms (especially transformer models, which understand nuanced relationships in language). And it’s not just about generative models. McKinsey recently published a global survey on corporate AI usage, showing that all the focus on generative AI is promoting wider adoption of AI in general.

Gabriel Andraos (Co-Head of Voya Machine Intelligence, Research and Development): Exactly, the scope extends well beyond gen-AI. Research in graph networks is going to be significant for enterprises, yielding more sophisticated outputs in specialized knowledge domains. We’re seeing better models for forecasting weather, discovering new materials and identifying genetic mutations that cause diseases. Deep learning has also made major strides in fundamental sciences, including chaos theory (such as for three-body systems), which have no analytical solutions.

Source: McKinsey Global Survey on AI, 02/22/24 to 05/05/24, representing 1,363 companies, with participants at all levels of their organizations.

Stein: So how do you think these developments affect the macroeconomic outlook from a standpoint of productivity, growth and inflation?

Brian Timberlake, CFA, PhD (Head of Fixed Income Research): The immediate benefit is from the capex. The arms race to build data centers should do a decent amount to support U.S. GDP growth in the near term. And there are plenty of applications ripe for AI to enhance productivity, such as communications and customer interactions. Beyond that, a lot is possible, but the timeline is further out and much less certain.

Finnegan: The impact on productivity will depend on the pace of adoption and how willing companies are to replace human workers with AI agents. Previous automation has focused on simpler tasks. But as AI gets better at mimicking human reasoning and communication, you can meaningfully increase the complexity of tasks. That has major implications for cost savings, but it also suggests a bigger departure from how enterprises go about their business.

Barbara Reinhard: I would also underscore that AI is inherently disinflationary in the long run. More consumer surplus, more productivity, more distribution of knowledge. People will be able to do more in fewer hours, which pushes cost structures down.

Stein: Speaking of labor, is AI a substitute for labor? Does it take jobs away? Or is it a supplement, helping people do their jobs better? Maybe a bit of both, depending on industry or skill level.

Finnegan: Higher productivity doesn’t automatically lead to job losses. While some industries will be more affected and certain skill sets may become outdated, AI can help alleviate bottlenecks in talent—such as in software coding—allowing firms to increase output. Those are the areas ripest for AI adoption. It’s more of a redirection of jobs than an outright reduction.

Reinhard: I would think of it like robotics. While robots have replaced some assembly line jobs, there’s a multiplier effect created by the need for people to program and maintain the robots. I think the multiplier effect for AI jobs will be even greater. Time and again, technology has shown that it enhances job opportunities, just in different areas.

William Marble, PhD (Senior Equity Analyst, Technology): Enterprises are investing in gen-AI today with the expectation of a meaningful return on investment (ROI). Initially, that ROI is achieved primarily through elimination of rote labor—hours spent by employees on repetitive, knowledge-based tasks. That’s what justifies industry spending $100 billion on GPUs in 2024 and $500 billion on data centers over the next few years. Typically, technology shifts are gradual enough to accommodate reskilling. But with AI, capabilities are evolving at such a rapid pace that it could put some pressure on employment.

Thomas: Whenever we discuss productivity in an economic setting, it raises issues because it’s measured from the perspective of a manufacturing economy. The productivity gains of the digital era have been ephemeral. Some of the benefits end up as consumer surplus, given away through lower costs and better-quality goods and services. But it’s difficult to quantify in terms of the macroeconomics.

Stein: You’re referring to the Solow paradox. In 1987, economist Bob Solow famously remarked that you could see the computer age everywhere but in the productivity statistics. They had massive growth in technology spending and computing capacity in the ’70s and ‘80s, but it didn’t translate into more productivity, because the statistics were largely based on manufacturing jobs post-World War II. I agree that it’s tough to measure productivity benefits in a services-led economy. The optimist in me believes that AI will be complementary, but the shift will undoubtedly pose societal and political challenges as workers transition their skills.

Finnegan: We know the competition for AI talent is fierce right now. I’m interested to hear from the group, as this rolls out to broader industry, how much AI talent do companies need? Because it seems to me that AI tools are becoming more user friendly.

Marble: It’s a huge issue for enterprises because the talent gap is everywhere. You need a mechanism for training employees in all functions to rethink how they work. For example, a leading tech company rolled out homegrown AI chatbot tools internally, and it took a full year of internal education and training before usage evolved to management’s satisfaction. For enterprises, we think deploying AI internally will be a multi-year journey. On the enablement side, there’s a severe shortage of developers, project managers and product managers with AI-specific skill sets. That talent shortage is going to be a barrier to the pace of adoption.

Andraos: That’s a good point, Bill. So many installation projects fail due to human resource issues and not having the right talent to implement initiatives properly. It is vital for upper management to have the proper background to master the complex issues of cloud computing and AI. I imagine some reskilling is in order for many company leaders.

Stein: So then we have all these companies spending a ton on AI, buying GPUs. Nvidia is making money. But for the others, they may not see the benefits of these investments for years. At what point does the CFO come and tap the company’s innovators on the shoulder and tell them to rein it in? Does capex start to slow down?

Andraos: The companies investing heavily right now in next-generation services are tech-forward companies betting that they can create value now and then figure out what to do with it later. These are long-term investments that you can’t simply plug into a discounted cash flow (DCF) model. You have to account for a much higher volatility in the terminal value. Something will happen, but that terminal value won’t be what you guess it is today.

Stein: Yes, that’s my personal view: Give smart people the resources they need and let them go to work. But does the pressure of quarterly earnings exert some pushback on that approach?

Thomas: The technologists hold the keys right now. Companies are running as fast as they can because they sense we’re getting close to AGI-level capability. If one of these big companies pulled back their AI spend, their top AI researchers would be out the door to competitors and startups pushing the frontier. So the cap on spending is less about CFOs and more about energy supply. They’re constrained by the energy infrastructure and the availability of power to run these data centers.

Macro takeaways

|

Energy: Feeding power-hungry GPUs

Stein: On the subject of energy, utility stocks—particularly independent power producers—have been some of the best performers year to date, at least in part due to the AI energy consumption story. There’s growing attention on the fact that we don’t have enough power to handle the coming onslaught of demand from AI equipment. What’s behind these constraints?

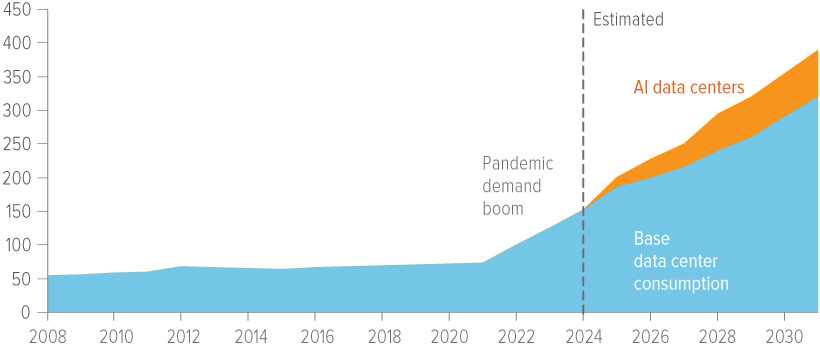

Ed Levin (Co-Head of Direct Infrastructure): AI is a game changer for the grid, and the grid’s not ready for it. Consider that one ChatGPT query uses ten times the energy of a standard Google search, and image and video generation is way more than that. Presently, U.S. data centers consume about 185 terawatt-hours (TWh) per year, roughly the same as the residential load of New York and Florida. S&P Global projects this will grow to about 250 TWh by 2035, essentially adding the residents of Texas and California. This surge is due to the added demands of AI data centers, as well as electrification and industrial reshoring. And at the same time, power efficiency gains are seeing diminishing returns.

For the past two decades, power demand in the U.S. has been flat. That means for 20 years, utilities have been asking regulators for approval to buy more power to meet demand that never materialized. Now they’re faced with the energy requirements of AI chips and cooling systems, which are expected to increase the energy load by 1.8-2.5% annually. That might sound small, but it’s huge.

The U.S. power industry simply isn’t structured to respond quickly to such disruptions. Unlike China, we can’t just decide overnight to bring new plants online. It takes us years to move through regulatory hurdles and permitting requirements into production. And regulators are skeptical after 20 years of flat demand. The prevailing view is that it will take a genuine energy crisis in the grid before regulators are convinced to expedite the necessary approvals.

As of 05/31/24. Source: International Energy Agency, Uptime Institute, BCG, Electric Power Research Institute, Lawrence Berkeley National Laboratory, Voya IM estimates.

Finnegan: I agree with that entire assessment. In about two years, electricity supply will likely emerge as the key bottleneck for AI growth—beyond any technological or capital factor. GPUs are just super-expensive paperweights if there isn’t energy to run them. Because of this shortfall and the time it takes to bring more capacity online, several trends are unfolding:

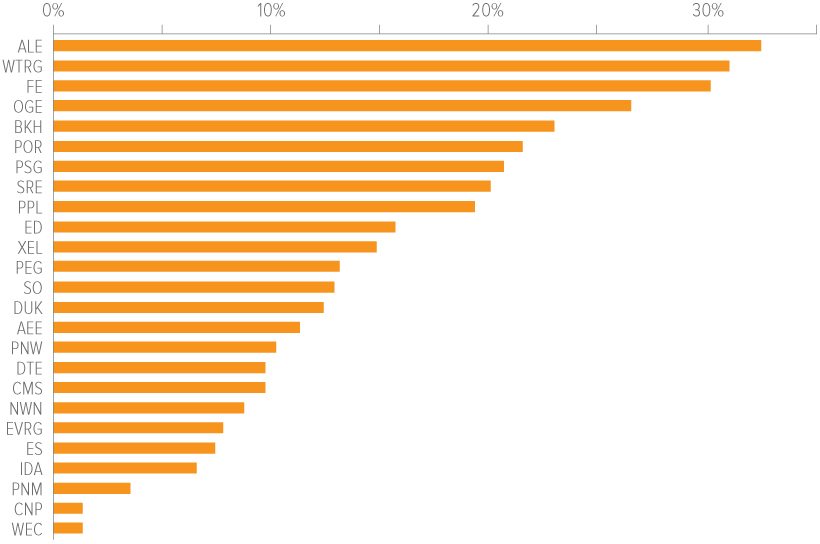

Utilities are revising their capital spending plans higher in anticipation of coming demand. Deregulated markets are seeing more future interest in direct current due to its faster speed to market. Companies are locating more data centers at the source of natural gas. This shift will likely drive natural gas prices higher over the next several years. Hyperscalers won’t be able to fully meet their emission reduction targets due to the intermittent nature of renewables. (Solar only works during the day, and wind doesn’t always blow.) And the sheer scale of gigawatts needed will lead to more gas-powered plants and slower retirement of nuclear plants to supplement renewable sources.

As of 03/31/24. Source: Wells Fargo Securities, company filings. Data reflects change in 3-5yr capex guidance provided (year-end 2023 figures compared with most recent guidance). ED comparison excludes CEP; WTRG excludes M&A; ED, FE and WTRG are average annual capex due to change from 3yr to 5yr capex plan.

Stein: It seems clear that powering AI will improve the economics of renewable energy projects, but it will also slow down the transition away from traditional energy sources. Some of it will depend on who’s in the White House and how federal power shakes out. I also wonder if this energy dynamic presents a risk of hoarding AI, so that it stays more clustered in the technology space.

Finnegan: That’s a risk. As you get beyond training AI models and start rolling them out to market, the energy usage increases significantly. If the energy supply isn’t there, it could delay the diffusion of AI adoption. That’s why the mega-caps are furiously scrambling to secure energy capacity looking out multiple years, agreeing to pay substantially more than the market rate.

Energy takeaways

|

Opportunities: Investing in AI

U.S. vs. international

Stein: What do investors do with all this information? Before we dive into specific investment plays, Barbara, your team looks at the big-picture asset allocation perspective. You’ve been bullish on U.S. equities compared with other markets, and tech is a large component of that. Do you think that trend continues?

Reinhard: Yes, we’re sticking with that view. You can argue that sentiment for the U.S. looks somewhat overbought. But sentiment isn’t a great indicator of a market top; it’s much more relevant to market bottoms. There are a few examples of stocks with extreme valuations, but in general there seems to be healthy skepticism. And I don’t buy the current emerging market story that some are putting out there. EM doesn’t look great technically, relative to the U.S., and China hasn’t done enough to put a floor under the housing market—it’s too big to fail and too big to save.

If you’re thinking about buying Europe over the U.S., that’s really a bet on European banks over U.S. tech. That’s a hard case to make, in my opinion. For now, we’re sticking with a home-country bias. Even with data potentially strengthening in Europe, it doesn’t look sustainable for the region to outpace the U.S.

Enablers

Stein: So if someone is bullish on AI, where do they start?

Thomas: Well, right now, all roads lead to Nvidia, which now makes up 19% of the MSCI tech index — which is crazy, but it’s being driven by real earnings and cash flows. Taiwan Semiconductor and semi cap equipment companies are also benefiting to the extent that they’re pushing leading-edge production for things like high-bandwidth memory, which is in short supply.

Finnegan: I think it’s important to delineate between workloads as enterprises begin testing applications. You also have to look at hardware names, such as SMIC, Dell and HP Enterprise, which may not command a large piece of the profit pool but are still in the sphere of AI’s influence.

As companies move from training and testing into production, we expect infrastructure software to accelerate, benefiting database companies like MongoDB and observability services such as Datadog, eventually spreading to the broader software universe. That’s also when you’ll see AI benefits really start to proliferate across industries.

Adopters

Thomas: The thesis when we launched our AI fund was that every industry will benefit. So far, the story has been very tech specific, particularly with Nvidia, which has drowned out everything else. Eventually, we believe AI leaders outside of tech stand to realize significant benefits from automation and efficiency improvements. Some of that value will ultimately be delivered as consumer surplus, but we look for companies that are capturing an outsized share of the profits being unlocked by AI.

Marble: For the adopters, success is less about building net new infrastructure and more about infusing AI into existing service delivery models, to improve outcomes at a lower cost. This dynamic strongly favors incumbents with scale and data. We look for companies with clear, defensible strategies underpinning their investments in AI.

Energy

Levin: The widening gap between electricity demand and supply is very bullish for private renewable energy projects. Utilities are hunting for late-stage projects and are more willing to offer power purchase agreements (PPAs) due to their urgent need for viable projects. A few years ago, securing a PPA was a challenge, but now, projects are often worth more without a PPA, because investors are confident that utilities will offer higher prices going forward. Many developers are even forgoing contracts, anticipating better rates in the future.

Finnegan: On the public side, independent power producers have performed well recently, whereas regulated utility companies have some catching up to do, offering some relative value there. Profits for these regulated entities are directly tied to AI infrastructure expansion, since they recover the costs of new projects along with a regulator-set return on equity. The regulatory process isn’t likely to change dramatically in the next several years to meet the surge in AI-related demand. However, increasing infrastructure investment adds a growth component to utilities, which already feature attractive dividend yields and historically low valuations.

Risks

Stein: What would you say about the potential dangers or pitfalls around AI investing?

Timberlake: So much of the success of AI enablement and adoption depends on management teams having the skills and background to understand the problems they’re trying to solve and applying technology in the right way. A lot of AI initiatives fail, and you can spend a ton of resources going down the wrong path and end up having to backtrack. So it’s critically important that investors do their homework on company leadership.

Thomas: Absolutely. And regardless of how remarkable a technology is, it can get commoditized. Investors should look carefully at which companies are capable of delivering sustained, differentiated value. I remember first seeing a hard drive spinning at 7200 RPM, reading magnetic indicators. It seemed like rocket science. It turned out to be a commodity. The market is highly sensitive to perturbations and gross margins, because that’s the first place you’ll see economic value going somewhere else.

Finnegan: Around that issue of commoditization, our focus is on companies that provide proprietary value that they can get paid for—whether it’s leveraging their own data or penetrating markets that were previously inaccessible. AI may also eliminate traditional barriers to entry and let in new competitors. How will OpenAI disrupt Google’s search business? How will AI assistants on phones affect vendor and OEM lock-in? We’re starting to see what Apple’s future with AI looks like, but how will that play out? A lot of elements are going to shift over the next few years.

Investment ideas

|

Integrations: Investing with AI

Stein: Many active asset managers have been working on incorporating AI tools and other quantitative techniques into their investment processes. Gabriel, when you talk to clients about the work Voya has done in this area, they seem excited by the potential but also cautious given the newness of the technology. How do you frame the issue for them?

Andraos: The most important thing is that it’s not about letting machines run the show, it’s about combining the capabilities of humans and machines to capture the things we each do well.

Stein: Like in medicine, where machines read scans and offer up insights to augment the capabilities of human doctors.

Andraos: Exactly. It’s a copilot sitting next to the portfolio manager, helping them make better, faster decisions with a higher level of confidence. The first hurdle is knowing what humans can do better and vice versa. Humans are still much better at imagining a world that doesn’t yet exist and then deriving causal implications, which is key to understanding growth stocks. On the other hand, machines are great at identifying anomalies and seeing changes in patterns.

The next hurdle is data. If you look at weekly data for all the companies in the Russell 3000 over 20 years, you might have, say, 3.5 million cases to reference. That’s a tiny drop next to the trillions of tokens used to train GPT-4. So what do we do in the absence of Google-scale data? That’s where humans can inject knowledge acquired through decades of education and observation and interaction with the world. All that knowledge can be harnessed in the form of expert systems or probabilistic graphical models.

Stein: It seems that so much of what was built into the models at G Squared Capital, and then imported to Voya Machine Intelligence, is the feature set, which is driven by that human element up front, in terms of the ideas that go into optimizing the model.

Andraos: Yes, and then we take those features and create virtual analysts that find interesting patterns in the data, using machine learning to augment what our human analysts are doing. It’s also a loop, as the models are later improved by feedback from human analysts. I think that’s a very powerful approach to ensure you get the best of both humans and machines.

Stein: Brian, I know a lot of the attention around AI-driven investing is on the equity side, but is there an angle for fixed income portfolios?

Timberlake: Well, we know from the Merton model that there’s a mathematical link between a company’s structural credit risk and its equity valuation. So to the extent AI can add value to equity analysis, it should be able to enhance credit analysis. AI could also create advantages in the private credit arena for managers who have both access to data and AI expertise.

Predictions: Living in 2029

Stein: Let’s end with a little thought experiment. Imagine you’re sitting here five years from now. How is the world different from the antiquated ways of 2024?

Andraos — Small language models: Enterprise technical solutions for generative AI have shifted from relying on large language models—which require huge power for inference and sending data away to a remote data center—to smaller, highly targeted in-house (or in-cloud) models used as agents.

Finnegan — Creative disruption: Here in 2029, nearly everything we watch or read relies heavily on AI tools, marking a significant shift from the creative process we were accustomed to in the past. The debate continues over intellectual property rights, ethics, quality and the future of human-created works.

Marble — Authentication: Authored digital content will need to be authenticated via a global content registry to provide confidence that it’s not a deepfake or AI imitation—like a blue check on all things digital. Someone will monetize this as a service.

Reinhard — Robotics: AI-powered robots designed to navigate physical environments increasingly dominate manufacturing and agriculture, driven by technological advancements comparable to the emergence of LLMs in 2022.

Thomas — Cheap intelligence: The cost of intelligence falls dramatically due to fierce competition among the large foundational model providers, allowing for broader adoption of AI technologies beyond tech and driving meaningful consumer surplus as products and services improve and become more personalized.

Levin — Power grid: Absent a radical energy efficiency breakthrough, the AI evolution causes some grid disruption and forces the country to reexamine its current approach to grid construction.

Stein — Agile leadership: A world powered by AI makes customer preferences and trends move at an ever faster pace, thus forcing companies to get rid of outdated bureaucratic committee structures and to decentralize decision-making. AI ultimately drives a shift in leadership structures from “Command and Control” to “Trust and Inspire.”

And with that, thank you everyone for this great discussion. I expect we’ll be revisiting this topic for years to come. To our readers, we’ll see you in September, when we’ll take a look at the U.S. election and what it means for markets.

A note about risk Artificial intelligence (AI) may pose inherent risks, including but not limited to: issues with data privacy, intellectual property, consumer protection, and anti-discrimination laws; ethics and transparency concerns; information security issues; the potential for unfair bias and discrimination; quality and accuracy of inputs and outputs; technical failures and potential misuse. Users of AI-based technology and tools should take these risks into consideration prior to use of the technology. |