Credit spreads have come off recent tights, but the uncertain macro backdrop continues to favor a selective, patient approach to adding risk.

For most of this year, we have kept our multi-sector portfolios up in quality and short in spread duration—a stance driven by attractive carry, an uncertain macro backdrop, and tight spreads. The question we’ve been asked recently: Is it time to add more risk?

On the surface, it’s understandable. U.S. economic growth has held up better than expected. Corporate earnings have been resilient. And the resumption of government operations has removed one source of near-term uncertainty. But for fixed income investors, the more important question isn’t what has improved, but what do we still not know. And on that front, the list remains long.

Known unknowns could drive future volatility

Even as the government reopens, uncertainty remains elevated. The absence of non-farm payroll (NFP) and other government labor market data has made it harder to assess the true trajectory of employment. And while NFP data is set to return, a “clean” report won’t be available until January. Meanwhile, the Fed’s path has become less predictable, not more. At its latest meeting, the post-FOMC messaging cast doubt on a December cut, and several officials have reinforced a more cautious tone since then. In addition, leadership changes at the Fed, including Chair Powell and potentially Governors Cook and Miran, add further questions heading into 2026.

Finally, tariffs remain a structural wildcard. Key questions around the speed and magnitude of cost pass-through, as well as the outcome of the IEEPA Supreme Court case, inject meaningful uncertainty into the inflation outlook. Taken together, these factors reinforce our higher-quality positioning. And while recent widening offers tactical opportunities, we remain patient.

Corporate spread volatility returns

From a sector standpoint, securitized credit continues to stand out as a strategic play. The sector is relatively insulated from macroeconomic uncertainty, including tariffs, fiscal policy concerns, and geopolitical tension. In our view, securitized credit continues to offer more compelling value than corporate credit, where spreads have spent much of the year near historically tight levels.

However, the landscape is beginning to change. As we noted in last month’s edition, the engine of the business cycle is shifting toward AI-driven infrastructure and capex, and that shift is increasingly visible in the credit markets. Even the most cash-rich, high-quality technology issuers are tapping the bond market more aggressively to finance long-dated AI buildouts. The resulting increase in supply is pushing corporate spreads wider.

For now, the uncertain macro picture still argues against a broad increase in risk. However, if spreads continue to widen, opportunities could emerge. Because we have maintained a lower-beta, higher-quality stance, our portfolios are positioned to adjust quickly and take advantage of these opportunities as they develop.

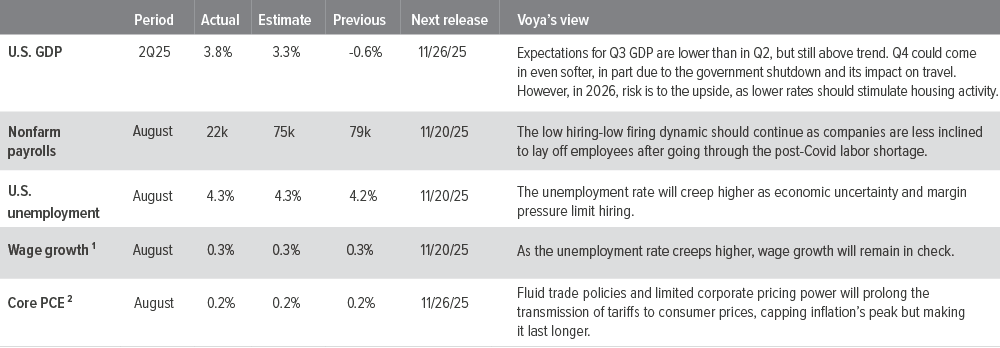

As of 10/31/25. Source: Bloomberg, FactSet, Voya IM.

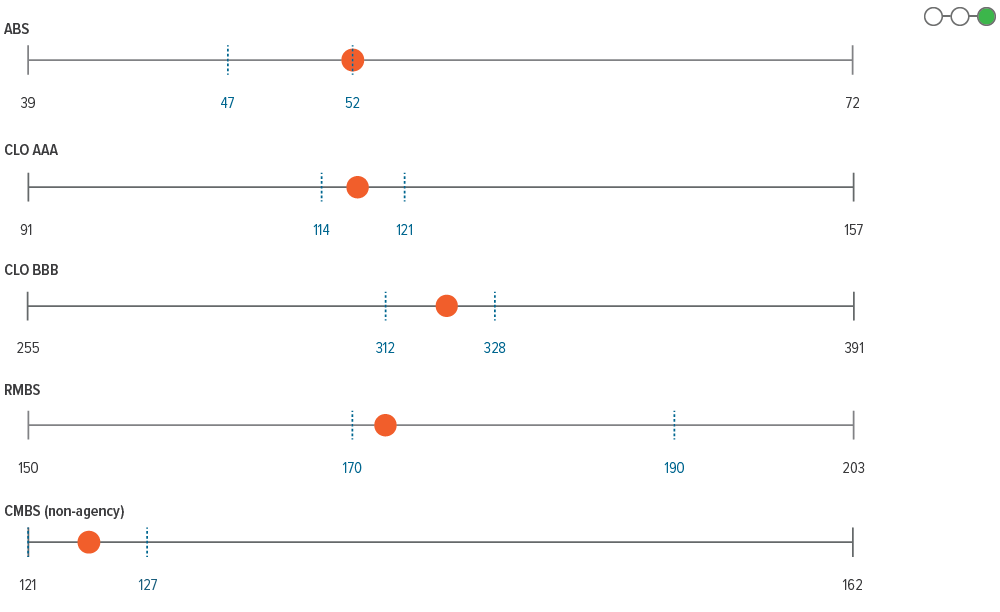

As of 10/31/25. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

- Corporate earnings for 3Q25 continue to exceed expectations, with tech and financials leading the way. However, more pronounced tariff impacts may flow through this quarter.

- Recent heavy tech issuance has driven spreads wider, but a year end rally could materialize as new issue slows.

- We continue to keep IG risk low as spreads are only slightly off historical tights. From a sector perspective, we prefer financials and utilities over industrials.

- With a few notable defaults, the market has become bifurcated, with investors showing a preference for higher quality names and lower quality names coming under pressure.

- The magnitude of uncertainty in the market backdrop favors defensive business models and balance sheets, particularly at compressed spread levels.

- Technicals are supportive but softer than earlier in the year, with cash levels down and new issuance picking up.

- Fundamentals continue to exhibit stable trends, as leverage remains well inside of recent averages, while coverage ratios have bounced off recent troughs.

- Loan borrowers, especially highly leveraged issuers, should experience some reprieve as rates decline.

- The First Brands default had a real impact on the loan market, as increased scrutiny over CLO managers has led them to become more selective and avoid “cuspy” names.

- MBS performed well in October, in part due to speculation over GSE buying; however no definitive plans have been announced as of now.

- Overall, fundamentals and a favorable technical backdrop are expected to bolster agency mortgage returns going forward, and the Fed rate cut provides a strong technical tailwind for levered players in the space.

- However, near-term performance can easily be swayed by large one-off trades from fast money and/or international investors.

- The fundamental picture is stable, despite a modest decceleration in growth. IMF upgrades for China, India, Brazil, and Mexico are supportive.

- Exports have held up, suggesting the trade impact from tariffs has so far been minimal.

- Valuations appear tight, while areas that screen cheap are for good reason.

- While corporate credit spreads are starting to widen, securitized credit continues to offer attractive relative value in the current environment.

- Despite solid fundamentals broadly, we believe ABS subsectors exposed to subprime consumers should continue to widen.

- In CMBS, the fundamental outlook improved, with more loans potentially becoming refinanceable if rates drop further. That said, there are still a handful of deals that will remain under stress, regardless of the rate environment.

- Strong credit fundamentals, paired with an increase in prepayment activity, should support RMBS returns into year end.

- While investors have become more focused on credit concerns, we still view high quality CLO tranches as an attractive relative value play versus traditional corporate sectors.