Amid the barrage of headlines, it’s tempting to react to every juke the market throws at you. Where should you focus instead? Start with these three trends.

A friend of mine who plays pick-up basketball once gave me some advice I believe is useful for investors: When playing defense, never watch the ball. Instead, watch the ballhandler’s body, specifically, their hips. Focusing on the ball will get you out of position but their hips will tell you where they’re going, and you’re less likely to get faked out.

The same goes for today’s markets. To help you keep your eye off the ball and on what matters, here are a few trends to focus on.

1 The U.S. economy is in strong shape

Four data points stand out:

- A healthy labor market. Unemployment has been hovering around 4%, driving solid growth in personal income for consumers.1 We do not expect Federal layoffs to have a significant impact on employment metrics.

- Positive GDP growth. While growth is expected to slow (from 2.5% in 2024 to an expected 1.8% in 20251), the U.S. economy is still one of the strongest among developed markets, and the prospect of recession remains relatively low.

- Declining inflation. Inflation has stabilized above the Fed’s traditional 2% target, but it’s significantly lower than the 9% we saw three years ago. We expect that its continued decline will be uneven and could take longer than expected.

- A strong U.S. dollar. The U.S. dollar remains strong and continues to serve as the global reserve currency despite President Trump favoring a weaker dollar. The dollar’s reserve status is unlikely to change due to its decades of credibility and the lack of a viable alternative.

As of 01/17/25. Source: Bloomberg, Factset, Voya IM.

2 Bonds are back to playing the role of portfolio diversifiers

2022 put the notion of bonds as diversifiers to the test, and this recent experience has led many to question whether bonds still effectively mitigate risk. However, despite isolated periods when bonds become positively correlated with stocks, their returns are historically uncorrelated.

We acknowledge that in 2022 the rapid and significant rise in inflation (and as a result, interest rates) led to a simultaneous sell-off in both treasuries and equities, delivering a double shock to portfolios.

However, the drivers of that inflation—such as excess savings, supply chain bottlenecks and a reduced labor force—have mostly corrected. Today, concerns that some of the new administration’s policies around tariffs and immigration may be inflationary, but we think they could be offset by other agenda items like deregulation and energy independence.

As of 12/31/24. Source: Voya IM. Data show the correlation between U.S. stocks (S&P 500) and U.S. bonds (Bloomberg U.S. Aggregate) for 5-year periods using daily data.

3 Several bond sectors offer attractive value

Rates are pricing in a higher-for-longer policy, as well as an attractive term premium to compensate investors for elevated uncertainty. This positions bonds to deliver positive results, even with fewer rate cuts and/or suboptimal policy sequencing. While rates will likely remain volatile, we expect a sideways move longer term.

With a steeper curve, we see value in longer-duration assets as the likelihood of rates moving significantly higher is low. However, we still prefer assets on the front and belly of the curve to harness carry and minimize price volatility, which we expect will remain elevated.

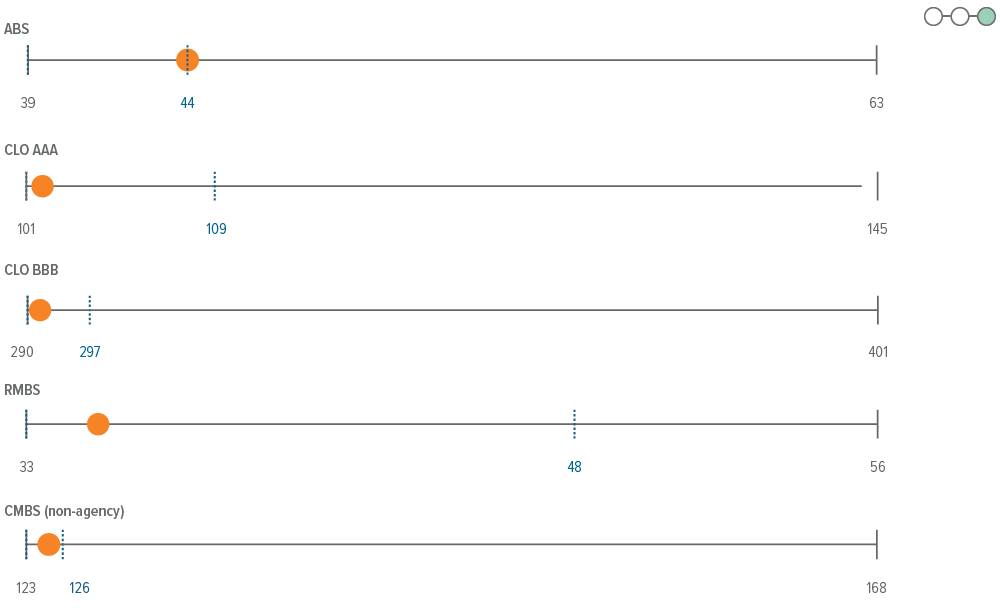

From a credit perspective, we prefer higher quality bonds given today’s spreads. However, there are still pockets of value to be found. For example, a strong labor market has a direct relationship to securitized sectors backed by U.S. consumers, such as asset-backed securities (ABS) and residential mortgage-backed securities (RMBS). Additionally, the continuation of a higher for longer policy rate is positive for floating rate and short duration securitized assets like collateralized loan obligations (CLOs), credit-risk transfer securities (CRT) and ABS.

As of 01/31/25. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

The bottom line

These themes are not new, but it can be challenging to find the signals in the noise—especially when the noise is growing louder by the day. Our advice? Try not to let the bouncing ball distract you. Instead, focus on the direction the data are pointing.

Sector outlooks

- With valuations tight, we believe volatility will create trading opportunities during the year.

- Lower 10-year yields should support the new issue calendar and we’d expect more issuance at the front end of the curve to take advantage of lower front-end rates and fade higher long end rates.

- 4Q24 reported earnings are beating expectations with notable outperformance in financials. We remain overweight financials and high conviction BBB names.

- The current yield provides enough carry to make it unlikely that negative total or excess returns will be achieved for an extended period, unless growth weakens significantly.

- However, with spreads near cycle tights, it is difficult to argue that investors are being paid for long-term risk.

- From a positioning standpoint, we are overweight food/ beverage and healthcare/pharma, and underweight technology, as well as media/telecom companies with structurally challenged business models.

- Overall, fundamentals and the supply technical will remain a positive influence on mortgage returns going forward.

- The correlation of agency mortgages’ performance with rate directionality should continue to weaken, as the sector’s high relative yields have attracted investor demand—going forward we expect fund flows to be a larger driver of returns.

- Uncertainty will likely arise from the political overhaul in Washington.

- While high starting yields should provide a buffer against potential volatility, credit selection will be critical as dispersion within and across sectors increases.

- A positive macro environment and easier financial conditions are expected to sustain demand for loans. However, stronger net supply, fueled by a rebound in M&A activity, may soften the current supply-demand imbalance.

- While corporate fundamentals should improve as rates decline and earnings growth rebounds, the market remains bifurcated, emphasizing the importance of careful credit selection.

- Looking forward, we project less volatility in securitized credit spreads as the post-election buzz fades.

- Strong seasonals and compelling mortgage credit fundamentals should ultimately drive RMBS outperformance. Pockets of weakness are becoming increasingly apparent in non-QM, but this subsector remains a small part of the overall mortgage credit universe.

- In CMBS, we are encouraged by office risk getting more traction in recent weeks, with SASB markets financing multiple office properties and brokers reporting an insufficient supply of ‘A’ quality space in a growing number of markets. Additionally, metrics in non-office properties should continue to improve while an increase in transaction volumes are likely to hasten the recovery.

- Positive seasonals and solid fundamentals in consumer ABS are offset by spreads that hover at multi-year tights and credit curves that remain compressed into the initial stages of higher volatility catalyzed by potential trade wars.

- Who likes higher for longer? CLO investors. While CLOs suffered cracks from 100 bp of rate cuts, the slower pace going forward steels investor enthusiasm, particularly if a pro-business policy mix keeps credit worries at bay.

- The growth outlook for emerging markets is modest, with risk skewed to the downside given risk of higher U.S. tariffs.

- Absolute yield levels remain attractive relative to historical levels despite the recent rally.

- Issuance is expected to slow sequentially in February but will likely remain robust.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.