As investors prepare for the effects of higher-for-longer rates and a new administration in 2025, we offer five themes we think will drive fixed income markets in the first half of the year.

1 U.S. policy to create short-term disruptions

Rhetoric from the administration will serve as a negotiating tactic, but actual policy will be watered down to have less of a negative impact. Uncertainty regarding sequencing, magnitude and duration of proposed policies will create short term disruptions, but market reaction will compel the administration to temper policies before they derail growth.

2 Global growth to be led by U.S.

U.S. growth will outperform the rest of the globe driven by post-election optimism and investment. Productivity gains from deregulation, innovation, and energy independence support higher potential growth in the U.S., whereas structural challenges in Europe will limit upside. China will provide additional stimulus but desire to limit further accumulation of debt will keep growth weak.

3 U.S. inflation likely to moderate but remain above Fed’s target

In the near term, inflation will continue to moderate, supported by a re-balanced labor market and a gradual decline in shelter costs, though it will remain above the Fed’s target. However, a policy mix of deficit spending, tariffs, and stricter immigration limits will threaten this balance by sustaining high level of demand while straining supply.

4 Central banks poised to diverge in policy

Central bank policies will become less synchronized due to diverging growth and inflation trends. The Fed will tolerate inflation above its target as they reduce policy rates. The ECB, facing weaker growth and falling inflation, will take rates below neutral. BOJ will be the outlier, raising rates due to inflation concerns.

5 Markets: Capitalize on dislocations

Higher nominal growth and a positive economic outlook will outweigh extended valuations, supporting growth-dependent assets such as equities and corporate credit spreads in the near term. In the medium term, missteps in policy implementation may create periods of market dislocation.

What the themes mean for investors

Despite stretched valuations across fixed income sectors, a backdrop of relative economic strength, easing inflation, and continued (albeit fewer) Fed cuts should be favorable for credit sectors in the first half of 2025. Investors may have opportunities to capitalize on short-lived market dislocations as the Trump administration looks to find the right balance in implementing its policy goals. For fixed income portfolios, security selection and flexibility in sector allocations will be key to generating alpha. We continue to favor high-quality, shorter-dated assets and are generally focused on income generation. If spreads widen, we will look to add market risk farther out the curve.

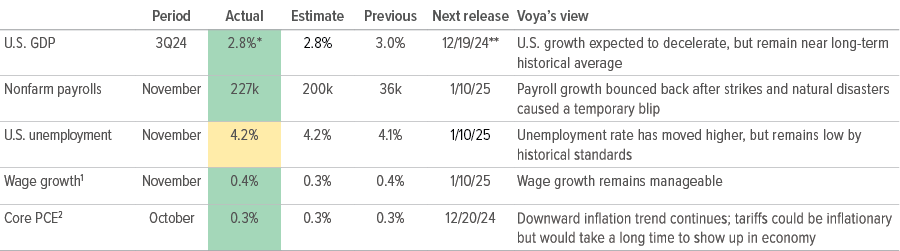

As of 12/14/24. Source: Bloomberg, Factset, Voya IM.

* Second estimate.

** Final estimate

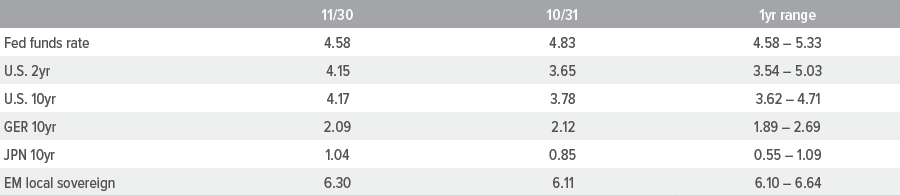

As of 11/30/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for index information. Past performance is no guarantee of future results.

Sector outlooks

- Fundamentals remain supportive, with third-quarter corporate earnings beating expectations.

- In aggregate, third-quarter S&P 500 earnings increased by 8.7% on 5.4% revenue growth. Technology was the main driver, with ex-tech results of 2.3% earnings growth and 3.9% sales growth. Financials and non-cyclicals were also solid, delivering 8.1% and 8.2% earnings growth, respectively.

- Among industries, we are overweight banking, neutral on utilities, and leaning away from areas with M&A risk within industrials.

- While the market continues to be supported by high all-in yields, we are keeping some dry powder on hand as slowing top line growth and margin compression may provide opportunities to add risk at wider levels.

- We expect credit stress and defaults to remain limited.

- From a positioning standpoint, we are overweight food/ beverage and healthcare/pharma, and underweight technology, as well as media/telecom companies with structurally challenged business models.

- Strong technicals and stable fundamentals continue to support spreads, while high starting yields provide a cushion against spread widening.

- Loan borrowers, especially lower rated and highly leveraged issuers that have faced the immediate transmission of higher rates, should experience some reprieve as rates decline.

- Credit selection remains key in this environment and we’re paying close attention to forward growth/ profitability, downgrade risk, liability management prospects, loan-to-value, liquidity, and free cash flow flexibility.

- We expect fundamentals and the technical environment to provide continued support for agency MBS as we enter 2025.

- The correlation of agency mortgages’ performance with overall volatility and rate directionality should continue to weaken, as the sector’s high relative yields have attracted investor demand—going forward we expect fund flows to be a larger driver of returns.

- Heading into 2025, we will be monitoring rate volatility and the consistency of demand for the asset class.

- While EM currencies sold off in anticipation of a second Trump administration, current pricing suggests markets are expecting more moderate policies.

- Rollover risk has diminished given a robust new issue market that has restored access to frontier sovereigns and high yield corporates.

- Corporate fundamentals overall remain resilient and financial policy remains prudent. Corporate default rates are expected to be lower due to less defaults in Asia and Europe.

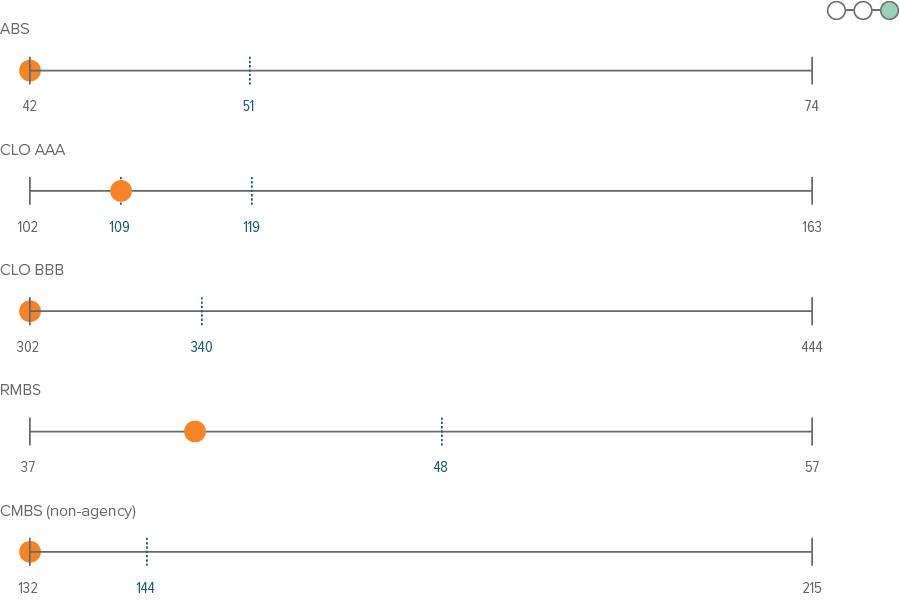

- Looking forward, we project less volatility in securitized credit spreads as the post-election buzz fades and the holiday season dampens market activity.

- Issuance in the ABS sector (a key theme over the course of the year due to its dynamism and robust pace) has finally shown signs of slowing and contributed to recent spread tightening.

- Looking ahead to 2025, we are monitoring CLOs to determine if the higher growth backdrop will help reduce perceived credit risk for underlying borrowers. The potential de-regulation of banks might also hasten their return as buyers of AAArated CLOs.

- The CMBS space is being supported by more liquid and active risk taking in secondary markets. We expect this to drive increased risk appetite more broadly across the commercial real estate universe going forward, which will further improve liquidity and risk appetite within the CMBS segment.

- The U.S. election results have created optimism for deregulation and above trend economic growth in 2025, supporting risk appetite for residential-mortgage credit. While optimism for a pick-up in prepayments has generally faded, easier financial conditions have supported more risk taking in the space.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.