In a resilient growth environment with inflation trending downward, any short-term volatility from the market’s reaction to monthly data is likely an opportunity to buy.

Separating the signal from the noise

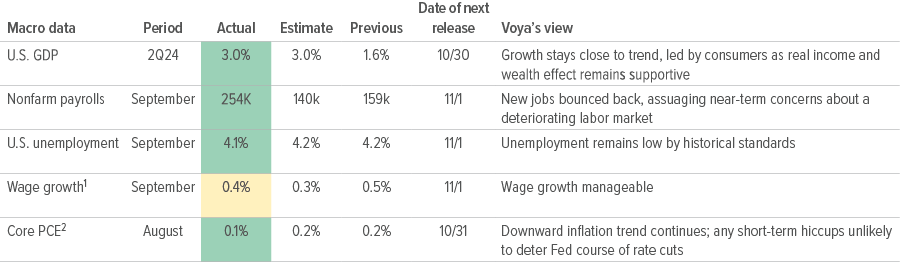

The roller coaster of recent employment readings has caused a fair bit of volatility lately. This month, we introduce a new macro dashboard to help explain short-term market movements, while providing context for the broader trends we expect to drive markets over time.

What could catch the market “offsides” in the short term?

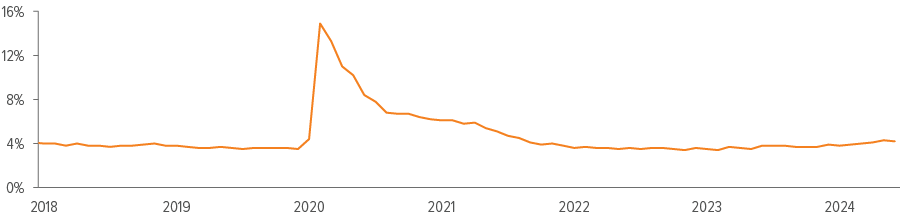

The Job Openings and Labor Turnover Survey (JOLTS) recently became an unlikely water-cooler topic. The July JOLTS showed a sizeable drop in available job positions (marking two consecutive monthly declines), causing some to speculate that the labor market was no longer trending toward moderation, but rather deterioration. In response, spreads widened and risk assets sold off. Of course, the August JOLTS showed an unexpected increase in job openings and the market’s fears of a deteriorating labor market subsided. After all was said and done, there was no change to the longer-term trend in the labor market.

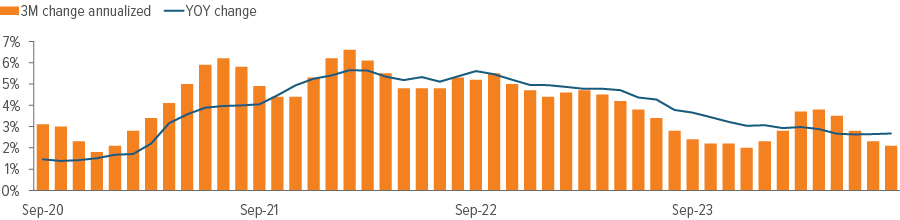

So, what could be the next catalyst for unexpected volatility? While the labor market and growth side of the equation have received most of investors’ recent attention, inflation hasn’t made many headlines. With the market more comfortable about a soft landing (or even no landing at all), near-term inflation surprises to the upside could cause some investors to worry that the Fed might pause or reverse course on its easing path. If this happens, remember that the trend is once again your friend.

The trend: Solid growth, declining inflation

In the context of the Fed’s dual mandate of supporting growth and keeping inflation near target levels, the overall macroeconomic environment is a solid growth environment with inflation trending downward.

As we have previously discussed, the Fed thinks of inflation in bands. When you get to 9% headline, you’re not in range. When inflation reaches 3% and trending down, you’re in range. Even if we have a hiccup or two of higher inflation, as long as the downward trend continues and growth remains resilient, spread assets should continue to benefit.

Avoid becoming overly fixated on the monthly prints and recognize that the trend matters more than one specific data point. In this environment, volatility caused by the market’s knee-jerk reaction to month-over-month data will likely be an opportunity to buy

As of 10/15/24. Source: Bloomberg, Factset, Voya IM.;

1 Average hourly earnings (month-over-month).

2 Month-over-month data, personal consumption expenditures price index

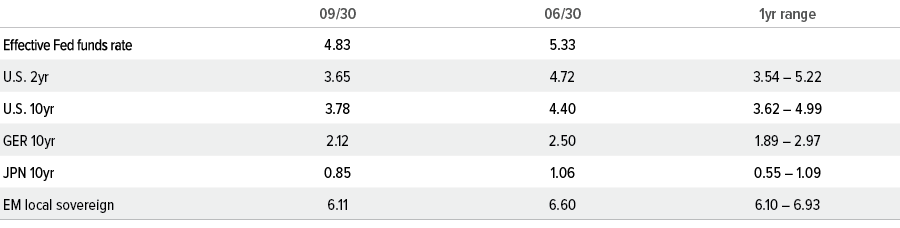

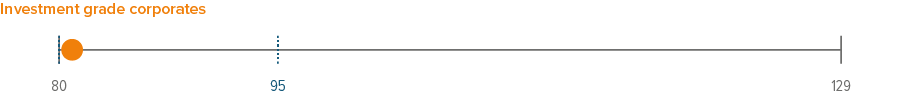

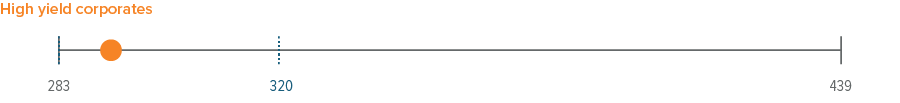

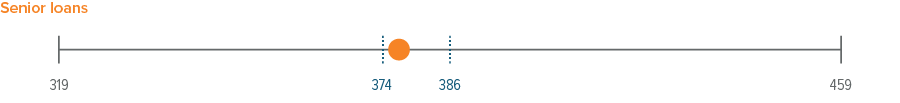

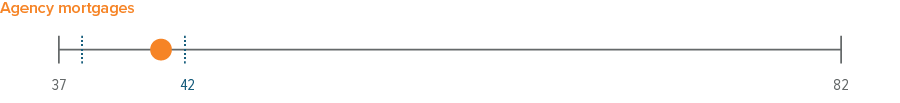

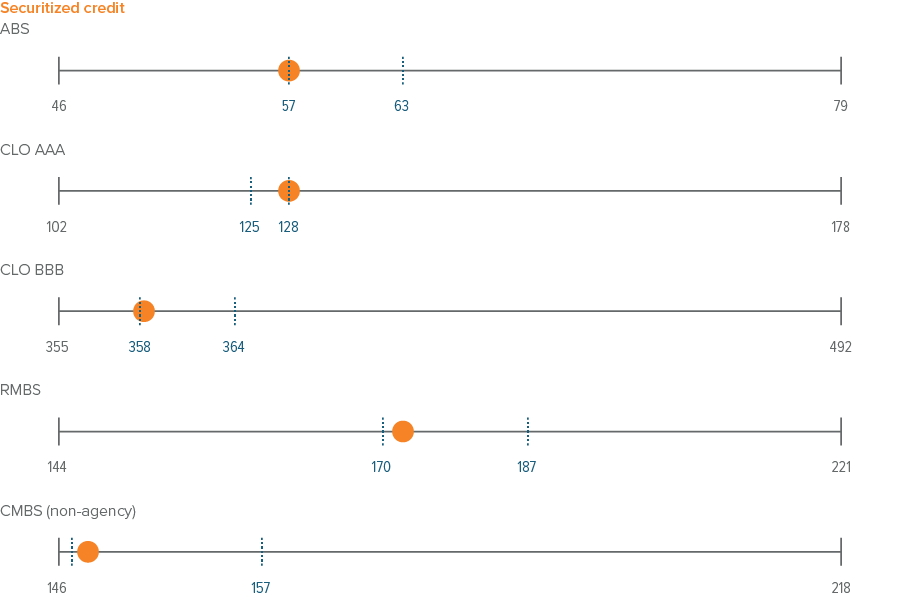

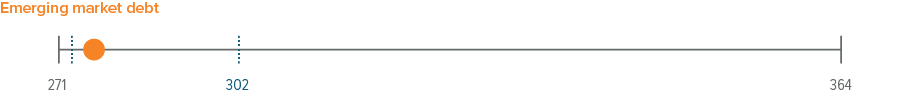

As of 09/30/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

As of 08/31/24. Source: U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics.

Sector outlooks

- Corporate earnings are forecasted to remain solid overall, with companies outside of technology expected to see an acceleration of growth.

- While September new issuance was higher than anticipated, we are still expecting net supply to turn negative in the fourth quarter, which should provide strong technical momentum for the sector into year end.

- From a positioning standpoint, we remain overweight financials, BBBs and the 10-year part of the curve.

- While the market continues to be supported by high all-in yields, we are keeping some dry powder on hand as slowing top line growth and margin compression may provide opportunities to add risk at wider levels.

- We expect credit stress and defaults to remain limited.

- From a positioning standpoint, we are overweight food/beverage, healthcare/pharma, and energy. We are underweight technology, as well as media/telecom companies with structurally challenged business models.

- The loan market performed well in aggregate and while returns have been relatively uniform across ratings segments year-to-date, lower-rated categories continued to outperform given the stable macro backdrop.

- The fundamental trajectory for most borrowers remains positive, and risk is largely concentrated in specific pockets of the market.

- Credit selection remains key in this environment and we’re paying close attention to segments in consumer services for further evidence of continued deceleration given the lower guidance in industries such as airlines, hotels, autos, and manufacturers.

- We remain cautious of cyclical sectors and those areas of the loan market that are reliant on discretionary consumer spending. In our underwriting process, we are paying very close attention to a company’s forward-looking growth and profitability prospects, downgrade risk, liability management prospects, loan-to-value, liquidity and free cash flow flexibility

- Overall, we expect fundamentals and technicals to support mortgage returns for the remainder of 2024.

- Despite the Fed’s 50 bps cut in September (and expected cuts in the future), lower coupon TBA financing rates have not adjusted accordingly, making this part of the coupon stack less attractive.

- The correlation of agency mortgages’ performance with overall volatility and rate directionality should continue to weaken, as the sector’s high relative yields have attracted investor demand—going forward we expect fund flows to be a larger driver of returns.

- Amid a landscape of robust securitized issuance and, on balance, supportive macroeconomic environment, the securitized credit market is demonstrating resilience, buoyed by the relative strength of U.S. consumers and initial repair in commercial real estate.

- New issuance for ABS is set to slow, which should improve technical conditions going forward. We see risk in sub-sectors tied to lower-income consumer cohorts, particularly as labor markets moderate.

- After a long streak of outperformance, CLOs are more vulnerable to falling rates and slower economic growth, with the sector facing potentially headwinds from the Fed reducing rates and the feed through into lower CLO base rates (3-month SOFR.

- Improved financial conditions have helped reduce the crisis like spread premiums once available in CMBS, effectively reducing “easy money” opportunities. As remaining problem loans continue to resolve, collateral based security selecting will slowly but surely replace simply asset allocating to the sector and “buying the sector.” In addition, the space should benefit from lower rates, especially for instruments with shorter repayment profiles that continue to trade at steep discounts.

- Residential-mortgage credit behavior is set up to remain insulated from a modest decline in home prices. Average mortgage rates for existing homeowners are <4% and the buffer of homeowners’ equity remains at or near historical highs.

- Absolute yield levels for emerging market debt remain attractive relative to historical levels despite the recent rally.

- Rollover risk has diminished given a robust new issue market that has restored access to frontier sovereigns and high yield corporates.

- Corporate fundamentals overall remain resilient and financial policy remains prudent. Corporate default rates are expected to be lower due to less defaults in Asia and Europe.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.