An unexpected shock in the banking sector has stress-tested the economy and policymakers. Both initially passed. But the impact on lending and credit conditions remains unclear and increases the likelihood of a mistake by the Fed going forward.

Economic growth (mixed)

Housing and manufacturing are struggling, with U.S. PMIs moving deeply into contraction (46.3 in March), but the service sector continues to expand. We see early signs of weakness in the labor market, which is the last factor prolonging inflation and averting recession.

Fundamentals (neutral)

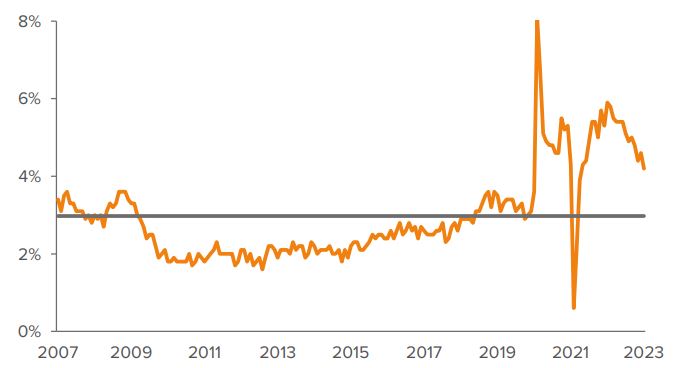

Consensus earnings expectations for 2023 and 2024 seem optimistic but well understood by market participants. We forecast S&P 500 Index earnings will be ~$200 per share for full-year 2023.

Valuations (negative)

Falling bond yields make equities relatively attractive, but U.S. valuations are not cheap. The equity risk premium is still above its long-run average.

Sentiment (positive)

Market based sentiment indicators are generally bearish, a contrarian “buy” indicator.

Quick take

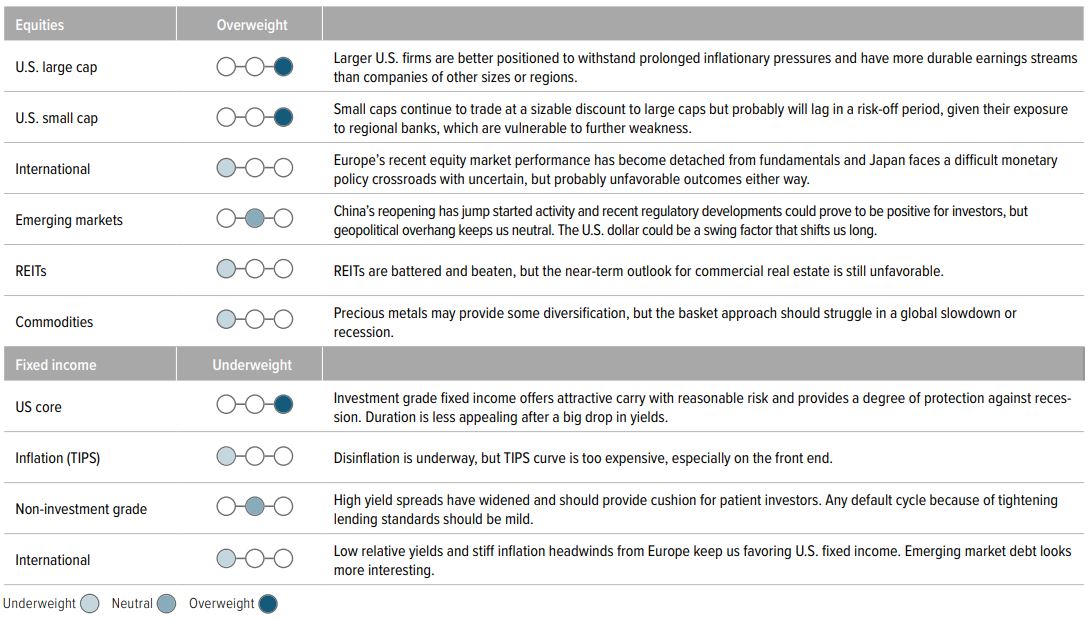

- After the banking sector shock in March, FOMC projections and the fed funds futures markets imply starkly different interest rate paths for 2023. The former suggest further hikes are on the horizon, whereas the latter suggest multiple rate cuts.

- Service sector inflation persists. Sticky prices tied to tight labor markets and strong wages have supported consumer spending and propped up GDP. There are signs service inflation is starting to decelerate. The question is: Can inflation fall faster than nominal GDP? If it can, we might be able to avoid a recession this year.

- U.S. equity market fundamentals are neutral. Revenues and margins are under pressure for some sectors, but there has been a lot of right-sizing of resources in the technology sector, which has been a leader this year. Earnings will struggle to meet estimates but the trough will come sooner than the consensus expects.

- Concerns are brewing that sticky inflation and declining money growth could stifle recent European equity outperformance. European stocks have caught some lucky breaks, e.g., a warm winter and subdued energy prices, but back-to-back quarters of negative GDP growth and lack of progress with structural challenges underscore risks.

- Currency dynamics could diverge by country, with emerging market currencies better positioned to strengthen, but the United States’ perceived “safe-haven” status still supports the U.S. dollar.

- We continue to favor high quality fixed income given high base rates, reasonable spreads and risks of impending recession.

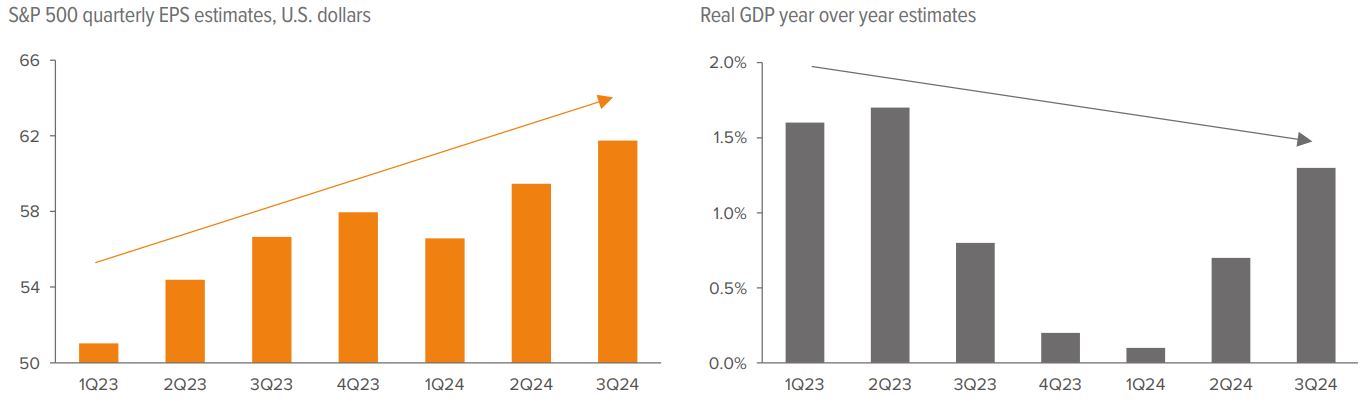

Portfolio positioning

Fundamentals appear mixed, but lower bond yields and the disinflationary impulse from 2022 monetary policy tightening should provide near-term support to risk assets. Voya recommends balancing risk-seeking positions with high quality tilts.

Investment outlook

Just over a year into one of the most aggressive Fed tightening cycles ever, in which the target interest rate has been increased from near zero to approximately 5%, financial stability ― or the perceived lack thereof ― has come to the forefront of policymakers’ and investors’ dashboards. The Fed’s theoretically simple but practically perplexing dual mandate of full employment and price stability has been made even more difficult by the sudden distress reverberating across certain segments the banking industry. While the Fed stepped in to provide banks with liquidity, further weaking in the financial system is plausible.

Given this risk and the expected tightening of lending standards ― particularly by smaller banks that have seen deposits dwindle ― market participants now believe the hiking cycle is nearly over and cuts are coming in the back half of this year. This marks an abrupt change from the beginning of March (Exhibit 1). Absent a collapse in commercial real estate or some other systemic shock, we think the Fed is unlikely to lower interest rates any time soon with inflation roughly three times its target. Instead, we expect the Fed to raise rates one or two more times and then enter a holding pattern around 5.5%, hoping that the relatively restrictive monetary conditions continue to gradually cool demand and ultimately prices, without spurring a financial meltdown.

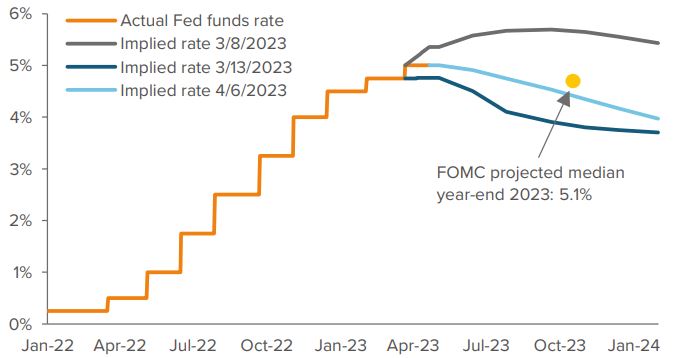

We believe the key to taming inflation lies in the service sector. Prices here have been sticky because labor markets remain tight and wages strong, helping support consumer spending. We do, however, see softening in these related areas. U.S. job openings have declined more than 10% since the start of the year and are fewer than 1.7 times the number of job seekers, which is down from more than two times late last year. Average hourly earnings growth are declining toward their long term average (Exhibit 2). Recent layoffs have been skewed towards white collar jobs, which tend to be higher paying. Combine that with lower net worth from falling financial asset prices and spending is likely to continue declining. What’s more, none of this recent data reflects the fallout from the banking industry issues. Together, these forces should weigh on services inflation. Whether inflation slows faster than the expected slowing in nominal GDP is unclear. If it does, we might be able to avoid an outright recession this year.

As of 4/6/23. Source: Bloomberg, Federal Open Market Committee projections materials (https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20230322.htm).

With the economy potentially headed for a contraction, it will be difficult for companies to grow revenue. Profit margins are also under attack from tighter financial conditions. Yet earnings estimates priced into stocks still forecast healthy growth for the full year (Exhibit 3). This appears overoptimistic given the current macro backdrop. However, there has been a lot of right-sizing of resources in the technology sector, which has been a leader this year. Earnings are going to struggle to meet estimates, but we think the trough will be earlier than sell-side forecasts and the market could look past the worst of it given that the earnings recession is already well understood on the buy side. Bond yields have declined significantly since the beginning of March, and we think inflation will fall below 4% faster than consensus estimates. As a result, equities could outperform in the near-term.

Accordingly, we have been tactically long U.S. large cap stocks with a tilt toward growth, which we think should receive a scarcity premium in this low growth world and could disproportionately benefit in the event of a reversal rally. Our medium-term view of U.S. stocks is less sanguine, so we are holding this position loosely. Our portfolios retain home-country biases with our largest underweight to international developed markets, primarily due to our unfavorable opinion of Europe. European stock markets dodged the winter weather bullet, but their unenviable situation appears little changed other than that they significantly outperformed over the last six months and the world seems to have gotten more comfortable with never-ending war in the eastern bloc, which makes us uncomfortable. Sticky inflation, declining money supply and back-to-back quarters of GDP contraction keep us from shifting our stances in the region. Japan looks better, but not great; after more than six years, it seems ready to abandon or significantly relax yield curve control. This would strengthen the yen but its impact on stocks is less obvious.

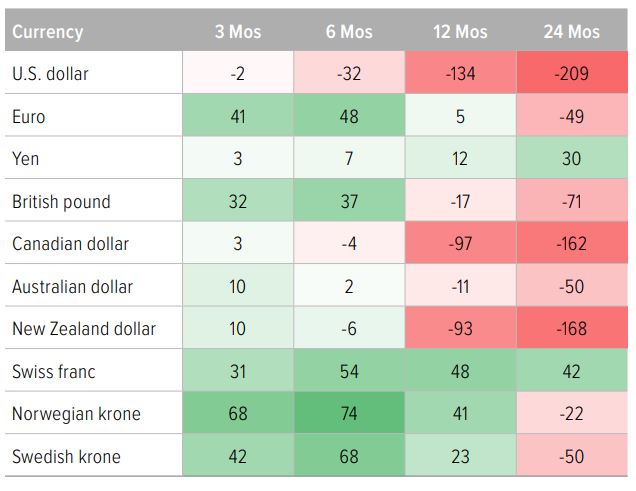

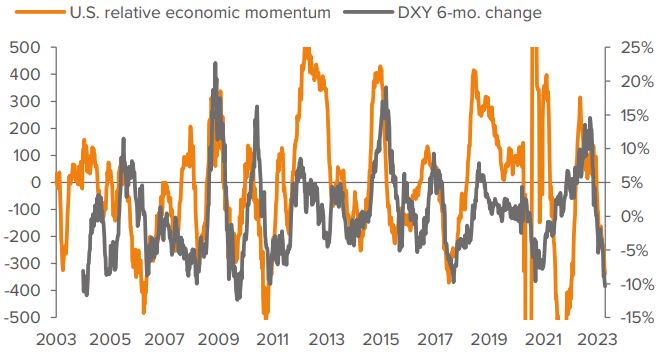

We prefer international emerging market stocks over international developed markets. Economic activity in China undoubtedly has picked up and may be one of the few global growth bright spots. Alibaba’s recent breakup suggests that the country’s hulking regulatory apparatus has evolved to limit local big-tech firms’ power while also preparing to release them back into growth mode. Nonetheless, we need more clarity around this and other simmering geopolitical matters to get confident with China. The other main driver of any broad emerging market investment is the direction of the U.S. dollar. The potential for an unwinding of recent U.S. dollar headwinds, including lower forward rate differentials (Exhibit 4) and negative relative economic momentum (Exhibit 5) could drive a reversal, but high starting valuations neutral positioning makes us believe the dollar will trade in a fairly tight range this year versus a trade-weighted basket. Nonetheless, positive growth differentials in developing countries, and fewer inflation problems, may help their currencies gain ground against it.

As of 3/31/23. Source: Bloomberg.

Real bond yields remain positive and present a compelling alternative to stocks. We are most drawn to corporate bonds and select investment-grade securitized issues, which offer considerable carry at reasonable risk and complement our long U.S. equity positioning. We have been reducing our duration tactically as yields have moved lower this year with signs of disinflation taking hold. There are juicy income plays among borderline distressed areas such as low quality commercial mortgage-backed securities, but we expect more defaults on the horizon. Overall yields appropriately compensate investors for the level of risk, but it’s not a good time to get greedy.

As of 4/18/23. Source: Bloomberg.

As of 4/17/23. Source: Bloomberg. Table data represent three-month overnight index swap forward curves.

As of 4/17/23. Source: Citigroup, Bloomberg, Voya Investment Management. Relative economic activity momentum is the differential between U.S. Citigroup economic momentum indexes and composite of Citigroup economic momentum indexes of the major components of the U.S dollar index peer basket (euro, yen, British pound, Canadian dollar) countries/regions as a proxy for international growth momentum. Data covering 4/17/21 – 3/11/22 were impacted by the extreme outlier Covid period, the making indicator for this period less useful.