The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

China's stimulus measures sparked a stock market surge, followed by consolidation as investors gauge the impact on economic growth.

Please find below our latest thoughts on China:

- Recent weeks have seen a slew of economic stimulus measures. There have been regular announcements ranging from high-profile press conferences to a series of local government initiatives piggybacking on the change of central government direction to a more pro-growth policy setting.

- The outcome has been a rollercoaster ride for China’s equity investors with an initial market surge followed by some welcome consolidation as investors assess the extent to which the measures are likely to alter China’s economic growth path.

- One thing’s for certain – brokers in China have been enjoying a purple patch. Records tumbled as trading volume on the Shanghai and Shenzhen stock exchanges reached almost USD 500 billion on 8 October.1

Source: Wind, Allianz Global Investors as at 15 October 2024. Past performance is not indicative of future results.

- After a few false dawns in recent years, a key question is whether this time the rally is different. We believe it is.

- This is not because we see the recent policy initiatives as a change to China’s strategic goals. The long-term objective is, in our view, still very much about building a future growth model based on technology-intensive manufacturing, and in so doing to reduce the reliance on property and infrastructure. Going hand-in-hand with this is the focus on national security, especially through the enhancement of self-sufficiency in critical industries.

- And we are also not expecting a “bazooka” fiscal stimulus. The last massive infrastructure programme came after the global financial crisis in 2008/2009 and is now widely seen as a damaging mistake which led to a temporary growth boost but left a longer-lasting debt problem.

- Instead, we view recent policy initiatives as an important change of approach which increases the likelihood of economic stabilisation, rather than being the pre-cursor to a new growth surge. This stabilisation is much needed if China’s longer-term vision is to be achievable.

- And if successful, this change of approach should, at least for the time being, remove some of the headwinds that have been blowing hard in the face of China equities, undermining both valuations and corporate earnings.

- Indeed, a key aspect of the policy announcements is the eye-catching focus on financial markets, with the provision of significant liquidity for share buybacks and stock purchases as well as a potential equity market stabilisation fund.

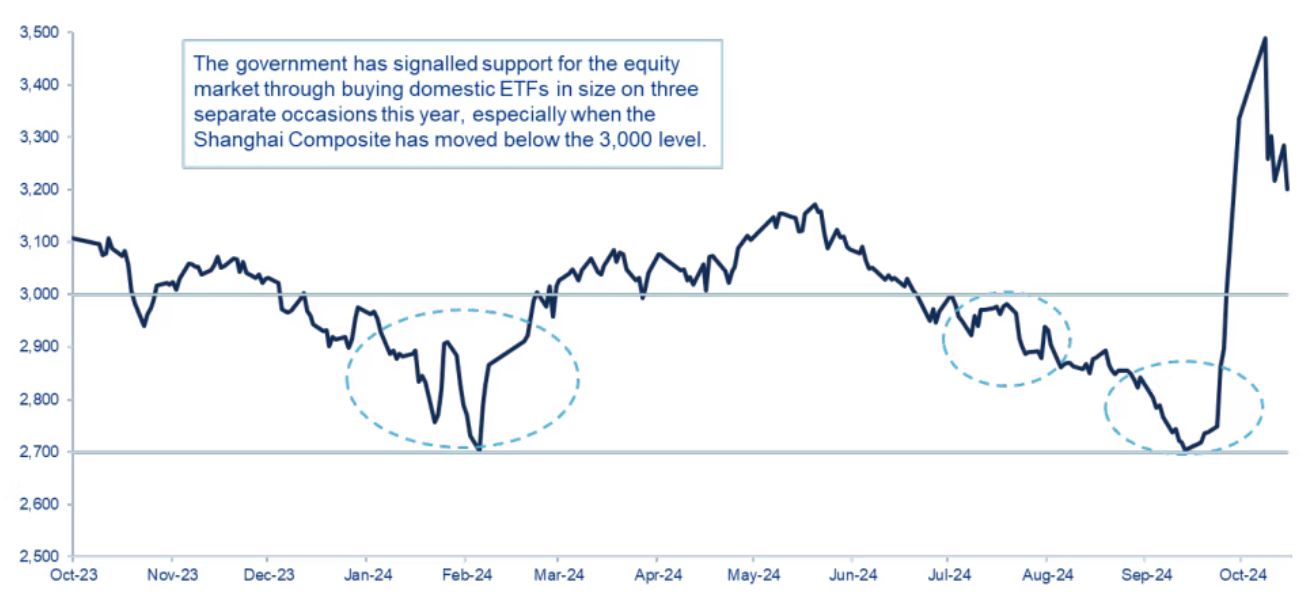

- There have now been three key moments this year when the government has stepped in to stabilise equity markets during periods of particular weakness – the first time was in January, then again in July/August, and most recently at the end of September.

- Each time the closely-followed Shanghai Composite index had fallen to a range of around 2,700 to 3,000. There should, therefore, be an increased level of confidence that this is a market floor. The current level of the Shanghai Composite is around 3,200.2

- So if we can quantify the downside with more confidence, what about upside potential?

Source: Wind, Centaline, as at 14 October 2024, using one month moving average.

- For sure, the challenges of stabilising the property market, easing the debt burdens of local government, and stimulating domestic demand to ease deflationary pressures are complex.

- However, in the words of Finance Minister Lan Foan at a press conference on 12 October, “the central government still has significant room for increasing debt and expanding the deficit.” That is a strong indication that there will be a meaningful step up in budgets and spending, and that policy priorities have shifted in a more growth-friendly direction.

- While we do not expect a massive fiscal boost, nonetheless there is now a significantly higher probability that a more expansionary approach benefits the real economy, and with it the stock market.

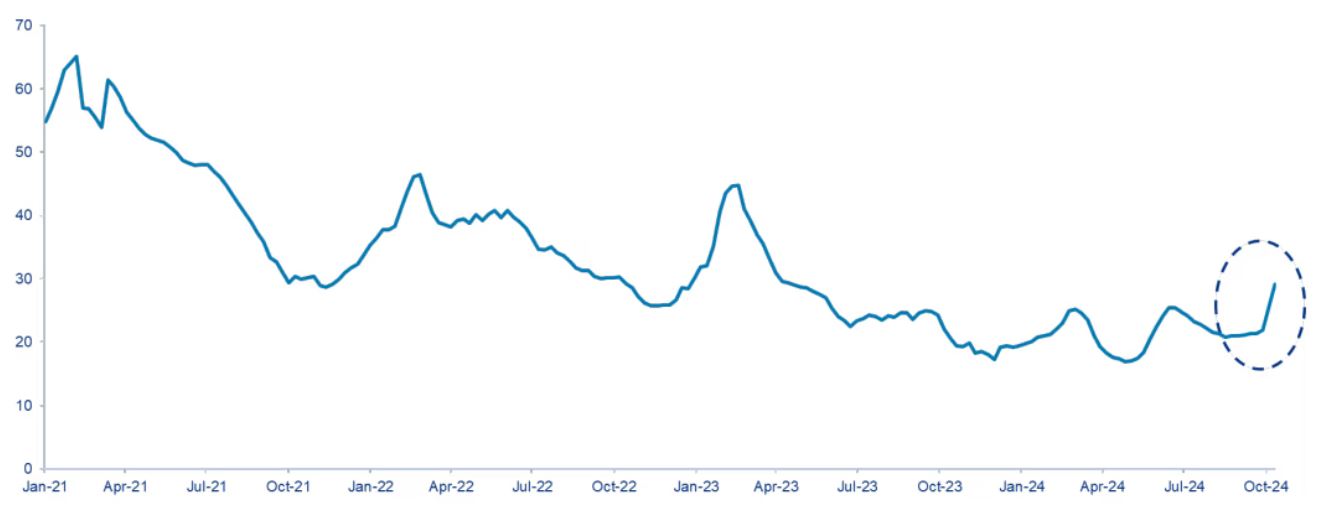

- Recent high-frequency data points already show some pick-up in secondary property markets, especially in larger cities.

- For example, the Centaline Asking Price Index in Tier 1 Cities, which include Beijing, Shanghai, Guangzhou and Shenzhen, has reached its highest point so far this year.3

- This index reflects a forward-looking view of homeowners on the price at which they can sell their property units. A rising index therefore reflects an improvement in bargaining power and as such can be seen as a leading indicator for the secondary home price trend.

- In summary, we are now in a situation where the government is easing both monetary and fiscal policies, and actively looking to boost asset prices. This is a different position from just a few weeks ago.

- With the likelihood of more supportive measures to come, and with market valuations still reasonable, our view is to buy the dips rather than to sell the rallies.