Key Takeaways

Banks are massively data-rich enterprises, which led them to adopt early AI tech such as machine learning, data analytics and regression analysis.

Until now, banks have largely used AI to find efficiencies and cost savings, but with so many playing the same game, that just means lower fees for everyone.

Generative AI could help lift the banking industry out of this spiral by establishing deeper, more meaningful relationships with their customers.

Gen AI is set to revolutionise banking, shifting the conversation from “can we do this cheaper?” to “how much can we deepen our customer relationships?”

For decades, banks have had a fraught relationship with technology. If they don’t continually invest in new tools, they risk lagging their peers or falling prey to upstarts that can deliver cheaper, easier-to-use financial products. That happens with every industry, of course, but for banking fees, it’s a race to the bottom. As everyone becomes more efficient, the same services are always available for less somewhere else.

It's in this context that we contemplate the next major technological wave – artificial intelligence (AI) – and its impact on the banking industry. AI has of course had a prominent role in banking and financial services for many years. But generative AI (gen AI) is different. It has the potential to lift the banking industry out of its technological doom loop and enable leading adopters to establish deeper and more meaningful relationships with their customers.

Traditional applications of AI in banking

Banks are about as data-rich as enterprises come, processing billions of customer transactions and interactions across digital and physical properties. Data like this is the lifeblood of AI, which is why banks have, for years, been investing heavily in AI tools such as these:

- AI-enabled trading algorithms and strategies

- Proprietary AI-powered payment processing methods

- Risk management tools that can detect fraud and boost compliance with financial regulations

- AI-powered chatbots and other support services

- “Recommender” systems that personalise offers and products based on a customer’s preferences and past behaviours

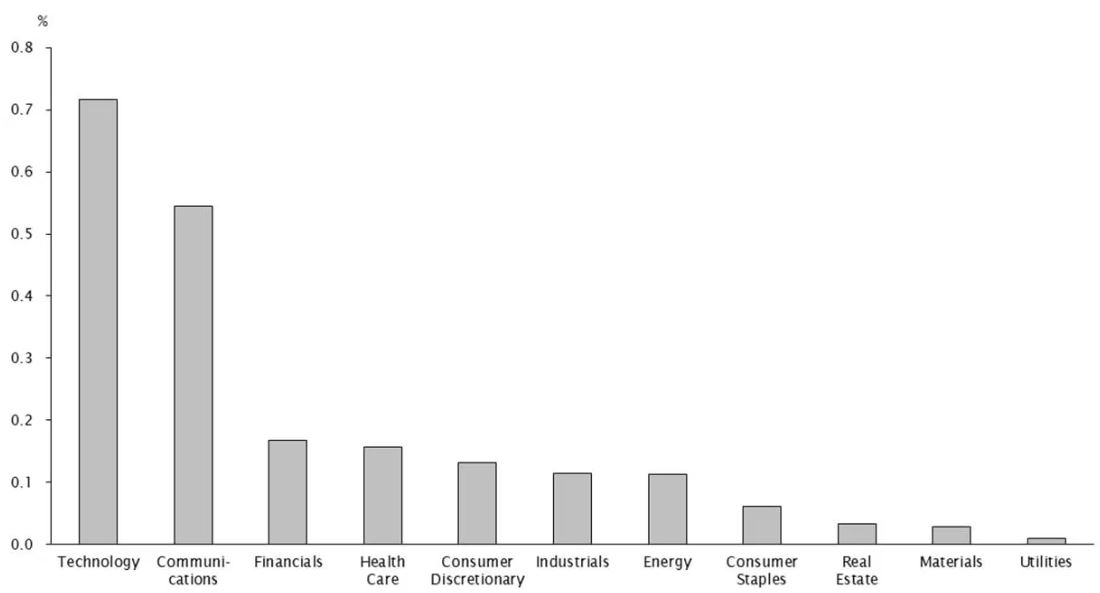

This data-centricity has been a reason why banks have been among the most prolific adopters of AI and other digital technologies. In fact, outside the technology and communications sectors, financial services companies (of which banking is a key industry) have sought to hire more AI-related professionals than any other sector (see chart).

Source: RavenPack, Empirical Research Partners Analysis as at June 2023. Based on job ads over a trailing 12-month period.

Gen AI can do things traditional AI can’t even dream of

So what are all these new hires doing? We know that before gen AI came along, banks focused on earlier forms of AI, including machine learning, data analytics and regression analysis. These methods are closer to pattern-matching systems – for example, payment authorisation systems that tag a particular transaction as potentially fraudulent by comparing them with verified instances of actual fraud.

But gen AI represents a paradigm shift that can help banks more fully unlock the power of their data. By ingesting a multitude of structured and unstructured data sets across business units and then learning the impact of their connections, gen AI systems give executives better visibility and insights into the risks and opportunities within and outside the bank. Gen AI will elevate decision-making from an isolated exercise of pattern matching to a systemic view of how to optimise bank operations and customer relationships.

In the next post, we’ll dive deeper into some of these areas.