The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security.

Cyber Monday in 2024 will likely end up being the year’s biggest shopping day – and one of the most vulnerable for consumers and companies.

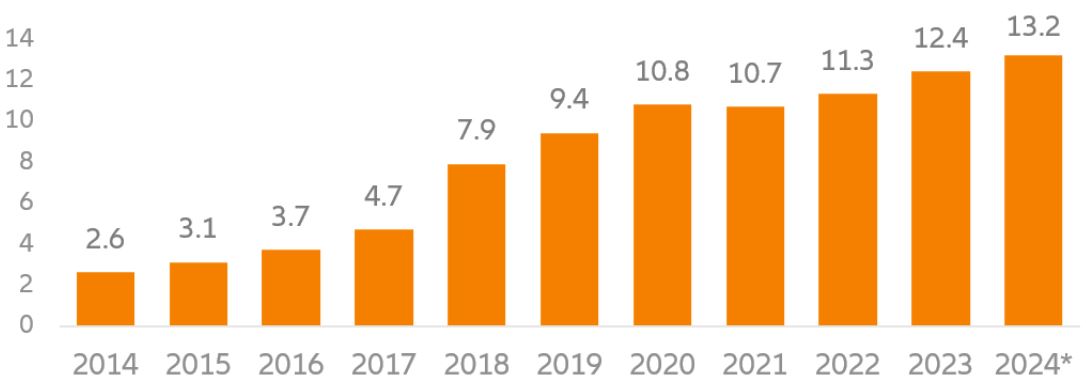

- Cyber Monday is now the largest U.S. online shopping day, with 2023 sales of more than USD 12 billion.

- For businesses, it adds more than revenue: It spurs advancements in digital marketing, payment solutions and data analytics.

- Cyber Monday also means cybercrime - including phishing, malware, data breaches and DDoS attacks – requiring increased vigilance from businesses and consumers.

The name Cyber Monday, introduced by the National Retail Federation in 2005, is Black Friday’s digital sibling – a day when millions of people shop online, looking for bargains. Initially viewed as an extension of post-Thanksgiving sales, it rapidly gained traction as consumers increasingly embraced the convenience of e-commerce. By 2020, Cyber Monday had grown into the U.S.'s largest online shopping day, fuelled by tech advancements, expanded internet access and consumers' increasing comfort with e-commerce. This trend shows no signs of slowing, with 2023 raking in over USD 12 billion in online sales.1

The event's explosive growth, driven by shifts in consumer behaviour and the rise of smartphones, has made it a global phenomenon. Retail giants and small businesses alike prepare months in advance, using strategic marketing campaigns and offering competitive discounts to capture shoppers' attention. The Covid-19 pandemic only accelerated this trend, making online platforms indispensable and cementing Cyber Monday's status as a must-shop event.

Source: Demandsage, as at 30 October 2024. *Estimated.

Cyber Monday is a goldmine for the retail sector, generating billions in revenue and marking the peak of e-commerce sales during the holiday season. Beyond sales, it brings retailers a host of new opportunities:

- Cyber Monday helps retailers boost fourth-quarter earnings, clear inventory and push the boundaries of digital marketing.

- It drives innovation in payment solutions, logistics and customer experience, setting new standards for speed, personalisation and service in e-commerce.

- It has also pushed retailers to adopt “omnichannel” strategies that seamlessly integrate online and physical storefronts.

- Competition among retailers is fostering advancements in customer service, from chatbots that provide instant responses to AI-driven product recommendations that enhance the shopping experience.

- Retailers also reap benefits from the data gathered during this period, boosting future targeted marketing efforts and refined product offerings.

But with great opportunity comes great risk. The online shopping frenzy attracts cybercriminals eager to exploit vulnerabilities. Here's what to watch out for:

- Phishing attacks: More email promotions mean more phishing scams, designed to steal customer credentials or financial data. Cybercriminals use sophisticated tactics, including impersonating popular retail brands to deceive consumers.

- Malware and ransomware: Fake apps and malicious ads – often disguised as harmless downloads or fake payment portals – can compromise personal devices and networks.

- Data breaches: Retailers and payment processors become prime targets as cybercriminals attempt to access vast amounts of customer data. Successful breaches can lead to severe financial losses and damaged reputations.

- DDoS attacks: Retail websites may be overwhelmed by traffic from distributed denial-of-service attacks, causing disruptions or outages that impact sales and customer experience.

To fortify against these threats, businesses are investing in advanced cybersecurity measures like end-to-end encryption, multi-factor authentication and AI-driven threat detection. Retailers are also proactively identifying vulnerabilities through penetration testing and implementing robust data protection regulations. But consumers also have a role to play: shop on trusted websites, keep security software up-to-date, and be wary of suspicious emails and links.

Cyber Monday’s evolution underscores its economic clout and the urgent need for robust security frameworks. Retailers must stay proactive in defending against evolving cyber threats, while consumers should remain vigilant to protect their personal data during this high-stakes shopping period.