1. If the acquisition of Fund units is subject to a sales charge, up to 100% of such sales charge may be collected by the distributor; the exact amount shall be mentioned by the distributor as part of the investment advisory process. This also applies to any payment by the Management Company of an ongoing distribution fee from the all-in fee to the distributor. The all-in fee includes the expenses previously called management, administration and distribution fees.

2. The investment opportunities described herein are for reference only but not guaranteed and are not indicative of future performance. The risks described herein are not meant to be exhaustive, please refer to the offering documents for details of risk factors (https://regulatory.allianzgi.com/).

AllianzGI: 1987073 | Voya IM: 3050248

Diversification does not guarantee a profit or protect against losses.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Indices are unmanaged and an individual cannot invest directly in an index. The Bloomberg Barclays US Government Credit Bond Index contains US Treasuries and agencies, Yankee and US corporate debentures and secured notes (publicly issued). The ICE BofA Merrill Lynch US Treasury Index tracks the performance of the direct sovereign debt of the U.S. Government. It includes all U.S. dollar-denominated U.S. Treasury Notes and Bonds having at least one year remaining to maturity and a minimum amount outstanding of $1 billion. Additional sub-indices are available that segment the Index by maturity. The ICE BofA Euro High Yield Index tracks the performance of Euro denominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets. The ICE BofA Global Corporate Bond Index provides a broad measure of the performance of the global investment grade corporate bond market. It includes publiclyissued corporate debt issued in the major domestic and Eurobond markets. The ICE BofA High Yield Master II Index is an unmanaged index consisting of U.S. dollar denominated bonds that are issued in countries having a BBB3 or higher debt rating with at least one year remaining till maturity. All bonds must have a credit rating below investment grade but not in default. The ICE BofA US Convertibles Index tracks the performance of publicly issued US dollar denominated convertible securities of U.S. companies. The BBG Barclays U.S. Credit Index is the credit component of the U.S. Government/Credit index. It includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements. To qualify, securities must be rated investment grade (Baa3 or better) by Moody’s. The index is the same as the former U.S. Corporate Investment Grade Index. The JP Morgan EMBI Global index is an unmanaged, market-capitalization weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities. The MSCI Europe, Australasia, Far East Index (EAFE) is an unmanaged index of over 900 companies, and is a generally accepted benchmark for major overseas markets. The Russell 2000 Index is an unmanaged index that consists of the 2,000 smallest companies in the Russell 3000 Index and represents approximately 10% of the total market capitalization of the Russell 3000. It is generally considered representative of the small-cap market. The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies.

The sub-fund is not for sale to or for the benefit of any U.S. person.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Funds mentioned are sub-funds of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organized under the laws of Luxembourg. The value of the shares which belong to the Share Classes of the Sub-Fund that are denominated in the base currency may be subject to an increased volatility. The volatility of other Share Classes may be different.

Past performance is not a reliable indicator of future results. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or willful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semiannual financial reports, contact the management company Allianz Global Investors GmbH in the fund’s country of domicile, Luxembourg, or the issuer at the address indicated below or www.allianzgi-regulatory.eu. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH,www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M,registered with the local court Frankfurt/M under HRB9340, authorized by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted.

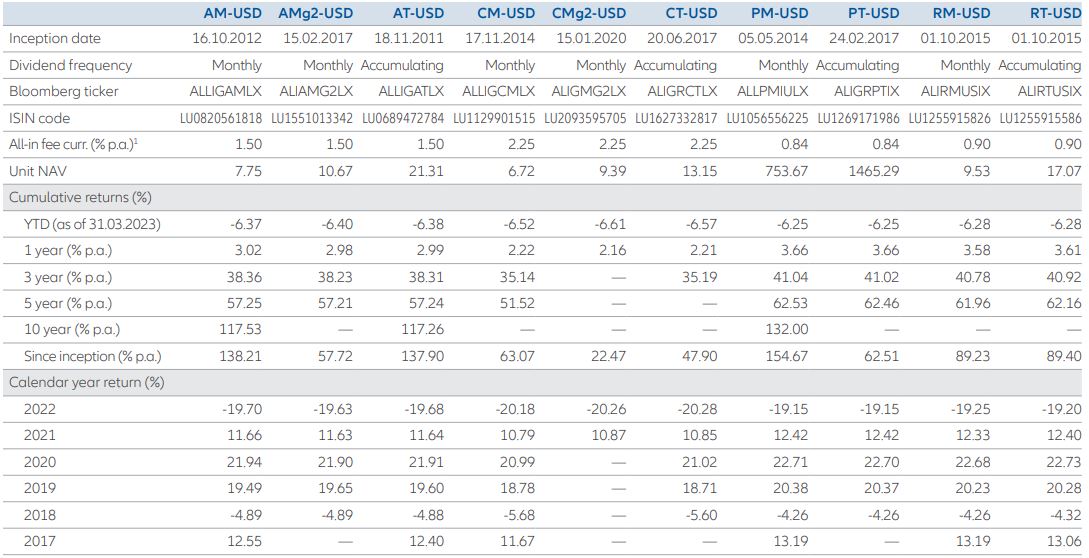

Fund performance is calculated on NAV to NAV basis in denominated currency of the respective share class with gross dividends re-invested. HKD/USD based investors are exposed to foreign exchange fluctuations This information is provided for information purposes only and is neither an offer to sell nor a solicitation of an offer to buy interest/share in any sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organized under the laws of Luxembourg (Allianz Fund). An offer is made only by the current Offering Documents, available upon request to qualified investors outside of the United States. Only qualified investors may invest in the privately offered investment vehicles. Allianz Funds are not offered for sale in the United States of America, its territories or possessions nor to any U.S. persons (as defined in the Offering documents), including residents of the United States of America and companies established under the laws of the United States of America. The information contained herein does not take into account investment objectives, financial situation or needs of any particular investor. It is for your use only and is not intended for public distribution.

Argentina: The distribution of this material and the offering of Shares may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person of persons in possession of this material and wishing to make application for Shares to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. Prospective applicants for Shares should inform themselves as to legal requirements also applying and any applicable exchange control regulations and applicable taxes in the countries of their respective citizenship, residence or domicile. This material does not constitute an offer or solicitation to any person on any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation.

Brazil: The fund may not be offered or sold to the public in Brazil. Accordingly, the fund has not been nor will be registered with the Brazilian Securities Commission - CVM nor has it been submitted to the foregoing agency for approval. Documents relating to the fund, as well as the information contained therein, may not be supplied to the public in Brazil, as the offering of the fund is not a public offering of securities in Brazil, nor used in connection with any offer for subscription or sale of securities to the public in Brazil.

Chile: This private offer commences upon receipt of the fund’s offering memorandum/prospectus and it avails itself of the General Regulation No. 336 of the Superintendence of Securities and Insurances, currently the Financial Markets Commission. This offer relates to securities not registered with the Securities Registry or the Registry of Foreign Securities of the Financial Markets Commission, and therefore such securities are not subject to oversight by the latter; Being unregistered securities, there is no obligation on the issuer to provide public information in Chile regarding such securities; and These securities may not be subject to a public offer until they are registered in the corresponding Securities Registry.

Colombia: This material does not constitute a public offer in the Republic of Colombia. The offer of the Allianz Fund is addressed to less than one hundred specifically identified investors. The Allianz Fund may not be promoted or marketed in Colombia or to Colombian residents, unless such promotion and marketing is made in compliance with Decree 2555 of 2010 and other applicable rules and regulations related to the promotion of foreign funds in Colombia.

The distribution of this material and the offering of the shares may be restricted in certain jurisdictions. The information contained in this material is for general guidance only, and it is the responsibility of any person or persons in possession of this material and wishing to make application for shares to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. Prospective applicants for shares should inform themselves of any applicable legal requirements, exchange control regulations and applicable taxes in the countries of their respective citizenship, residence or domicile.

Panama: The distribution of this material and the offering of Shares may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this material and wishing to make application for Shares to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. Prospective applicants for Shares should inform themselves as to legal requirements also applying and any applicable exchange control regulations and applicable taxes in the countries of their respective citizenship, residence or domicile. This material does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation.

Peru: The shares have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This material is only for the exclusive use of institutional investors in Peru and is not for public distribution.

Uruguay: The sale of the Allianz Fund shares qualifies as a private placement pursuant to section 2 of Uruguayan law 18,627. The shares must not be offered or sold to the public in Uruguay, except in circumstances which do not constitute a public offering or distribution under Uruguayan laws and regulations. The shares are not and will not be registered with the Financial Services Superintendency of the Central Bank of Uruguay. The shares correspond to investment funds that are not investment funds regulated by Uruguayan law 16,774 dated 27 September 1996, as amended.

AllianzGI provides services only to qualified institutions and investors. The material contains the current opinions of the manager, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts and estimates have certain inherent limitations, and are not intended to be relied upon as advice or interpreted as a recommendation.

AllianzGI provides services only to qualified institutions and investors. Allianz Funds are distributed in Latin America and the Caribbean by Allianz Global Investors GmbH and certain of its non-U.S. sub-distributors. Shares of the Allianz Funds may not be offered or sold in, or to citizens or residents of, any country, state or jurisdiction where it would be unlawful to offer, to solicit an offer for, or to sell such shares. Voya Investments Distributor, LLC serves as a U.S.-based sub-distributor of Allianz Global Investors GmbH. Voya Investments Distributor, LLC is a broker-dealer registered with the U.S. Securities and Exchange Commission. This information may only be distributed by authorized broker-dealers, intermediaries and other entities in compliance with applicable laws and rules in each jurisdiction in which it is distributed. This information is provided for informational purposes only and should not be construed as financial advice or investment recommendation, a solicitation or offer to buy or sell any securities or related financial instruments (collectively “financial instruments”) by AllianzGI or any other party to citizens or residents of, any country, state or jurisdiction where it would be unlawful to offer, to solicit an offer for, or to sell such financial instruments to such citizens or residents in such country, state or jurisdiction. AllianzGI is not affiliated with and assumes no responsibility for the use of this material by a party other than AllianzGI or its affiliates.

This information may only be distributed by authorized broker-dealers, intermediaries and other entities in compliance with applicable laws and rules in each jurisdiction in which it is distributed. This information is provided for informational purposes only and should not be construed as financial advice or investment recommendation, a solicitation or offer to buy or sell any securities or related financial instruments (collectively “financial instruments”) by AllianzGI or any other party to citizens or residents of any country, state or jurisdiction where it would be unlawful to offer, to solicit an offer for, or to sell such financial instruments to such citizens or residents in such country, state or jurisdiction. AllianzGI is not affiliated with and assumes no responsibility for the use of this material by a party other than AllianzGI or Its affiliates.