| The following content has been prepared by Allianz Global Investors GmbH (AllianzGI), and is reproduced with permission by Voya Investment Management (Voya IM). Certain information may be received from sources Voya IM considers reliable; Voya IM does not represent that such information is accurate or complete. Any opinions expressed herein are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. |

By Thorsten Rahn Quantitative Investment Strategist, risklab, Allianz Global Investors & Ernst J. Riegel Head of Global Risk Management Business, risklab, Allianz Global Investors.

Investing outside your home market can open up new opportunities. But it may also create challenges from fluctuating exchange rates. We see three ways to hedge currency risks.

Currency risks arise from gains or losses in investments due to changes in the value of one currency against another (typically, the currency in the foreign market where you are investing versus your home currency).

And we think such risks are rising up the agenda for many investors. One reason is that many big economies increasingly move at different paces. Interest rates – one factor in determining exchange rates – are less synchronised than they have tended to be, as central banks adjust rates to suit the changing needs of their economies. Geopolitics – which have loomed large over markets in recent years – can also influence exchange rates.

So, what can you do to mitigate currency risk?

Currency hedging can improve the predictability of results – ensuring an investment portfolio is protected from unforeseen shocks.

We see three ways to hedge currency risks:

1. Currency hedging via forwards

Hedging a foreign currency position using forward contracts has long been a popular choice for managing foreign exchange (FX) risk in a portfolio. Currency forwards are deals in the FX market that guarantee a certain exchange rate for the purchase or sale of a currency at an agreed date. They can be tailored to a particular amount and maturity. And they can help mitigate volatility in the currency being hedged. Some investors choose a 100% static forward strategy, meaning they hedge their entire foreign currency position and are then only able to rebalance it at the maturity of the forward contract. That may prove risky if exchange rates are volatile.

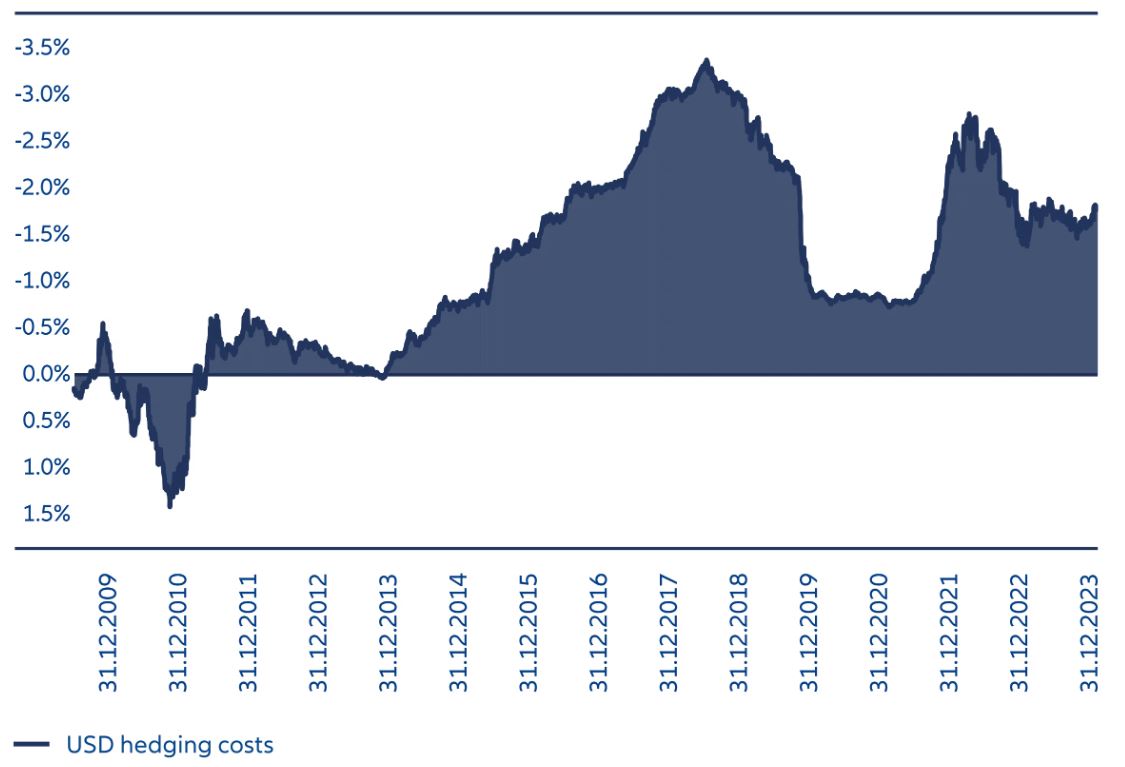

And currency forwards carry other downside risks. They can be associated with high hedging costs, depending on the difference in the interest rate between your home market and an overseas market. This differential has, for example, become particularly challenging for anyone in the euro zone investing in US assets. Interest rates in the US have been significantly higher than in the euro zone, and the differential is even wider between Japan and the US. As a result, there can be a significant cost to hedging a US dollar position from overseas. Over time, such fixed costs may diminish expected returns (see Exhibit 1).

Data as at 31 December 2023. Source: Bloomberg. The hypothetical cost development presented is for illustrative purposes only and does not reflect actual cost development; they are not a reliable indicator of future results.

2. Currency hedging via put options

A simple alternative may be an FX put option, offering potential protection from currency movements. Currency put options offer an opportunity – but not the obligation – to sell a specific amount of a foreign currency at a predetermined price once currency losses move above a predetermined level. The price of a put option is affected by factors ranging from the specific price the currency is sold at (known as the strike price), the timeframe of the intended protection, interest rates and market implied volatility. A put option increases in value as the price of the underlying currency decreases. But it loses its value as the price of the underlying currency increases.

We think put options may be preferable to currency hedging via forwards as they offer greater flexibility, providing potential protection against downward moves in the hedged currency as well as participation in any gains. If a currency move is unfavourable, there’s no obligation to trade at the maturity of the contract. In contrast, currency forwards are binding, so there is no way to terminate the contract.

The flexibility provided by put options may also have a diversifying effect on the underlying investment as the portfolio can benefit from any sharp increase in the hedged currency. Such moves are common for the US dollar at times of market stress and put options can serve to reduce overall risk during these times.

But put options have the disadvantage of high hedging costs. Options can be particularly pricey when exchange rates are stable as the premium for payment at the contract’s maturity date will be higher.

3. Currency hedging via collars

Collar strategies help to manage currency risk by limiting exposure to swings in FX rates to within a certain range. They comprise two option contracts, which combined can be a cost-effective alternative to using put option trades alone:

- A put option offering the right to sell a foreign currency at the strike price within a specific time period. As noted above, the put option provides protection against possible downward moves in the hedged currency, while providing the opportunity to benefit from any upward moves. For collar strategies, we would buy the put option.

- A call option offering the right to buy a foreign currency at a specified price (the strike price) within a specific time period. We would sell the call option using the premium to lower the cost of the protection. In case the hedged currency moves up, the return will be capped by the strike price.

The collar structure has all the benefits of the put option. It profits from any gains in the exchange rate and limits the downside risk but can be set up without paying the high premium for the put option. The collar structure takes advantage of generally higher premiums for call options on currencies, compared to the generally lower put premiums. In other words, you can often even get a profit from selling the call option and buying the put option when you choose the same protection and upside potential for the put and the call.

In fact, the ratio of the call to put premium has been relatively stable over the last 20 years, providing a favourable backdrop for hedging. Additionally, the strategy may profit from any rise in the hedged currency up to the strike price of the call.

Hedging with collars can be more expensive than using currency forwards in years of strong downward movement of the hedged currency. The additional cost is limited by the difference between the protection level and interest rate differential. But using collars is cheaper in environments where the hedged currency is moving sideways, slightly down or up. Overall, collar strategies provide lower hedge costs over the longer term compared to a 100% forward hedge as long as the interest rate difference is positive in favour of the hedged currency.

Need to know A. Put and call options allow buyers to take a particular action on an underlying asset (such as a currency) in the future if it benefits them. But there’s a difference in what they both permit. A put option gives the buyer the right – but not the obligation – to sell a particular asset at the strike price within an agreed time frame. A call option allows the buyer the right – but not the obligation – to buy a particular asset at the strike price within an agreed time frame. Investors purchase put options when they think the price of the underlying asset will drop and sell if they believe it will rise. They would buy call options when they think the price of the underlying asset will rise and sell if they believe it will drop. |

Which approach may be best for your portfolio?

Hedging can be a sensible way to manage currency risk. It is important to consider a range of factors when determining the best approach for your needs, including the FX spot rate and the interest rate differential, as well as levels of volatility and liquidity in the currency markets.

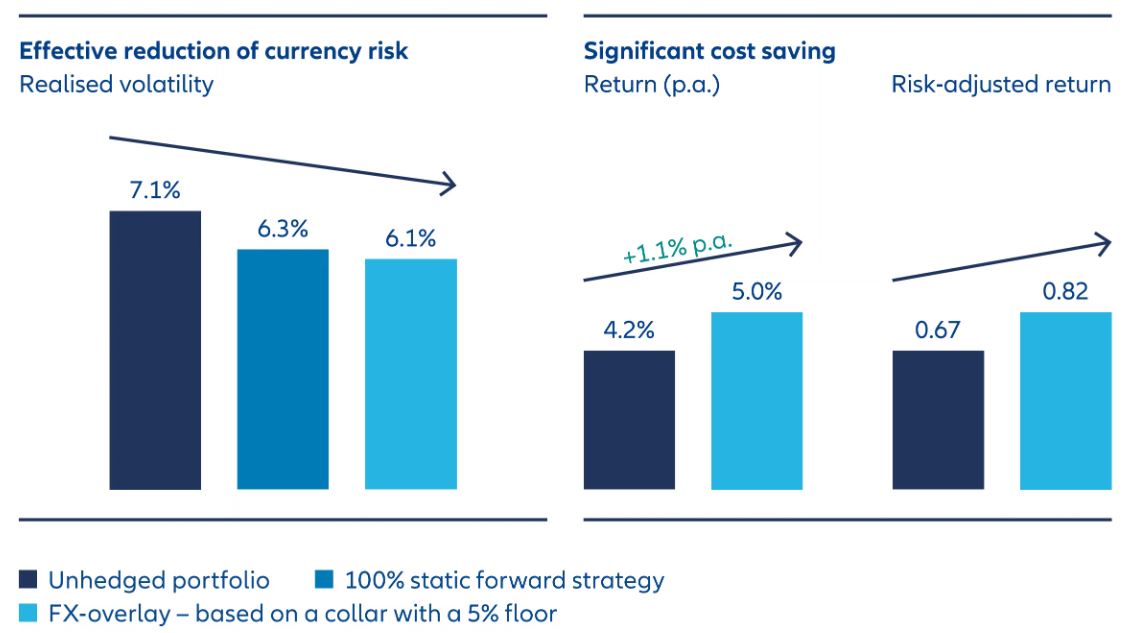

In general, for longer-term investors, we think option strategies may be the smartest solution: they help to reduce risk and costs more effectively and efficiently than forwards. This can mean a significantly improved Sharpe ratio, a measure of volatility-adjusted returns.

To demonstrate, we created a hypothetical standard asset allocation of fixed income, equities and hedge fund investments, with 65% of the assets denominated in US dollars. We then analysed how the portfolio may perform based on different approaches to hedging across realised volatility, average annual return, and risk-adjusted return. In all cases, the collar approach provided the best results (see Exhibit 2).

In an environment where currency volatility might be a bigger feature of investment markets, it could be a good time to review the currency risk in your portfolio and how to manage it most effectively.

Source: Bloomberg. Trading costs are not taken into account. The hypothetical performance and simulations presented are for illustrative purposes only and do not reflect actual performance; they are not a reliable indicator of future results.